Business Registration Certificate Guide for New Companies

This article will answer all the questions about why using an agency for your BRC is essential.

Last Update: March 2025

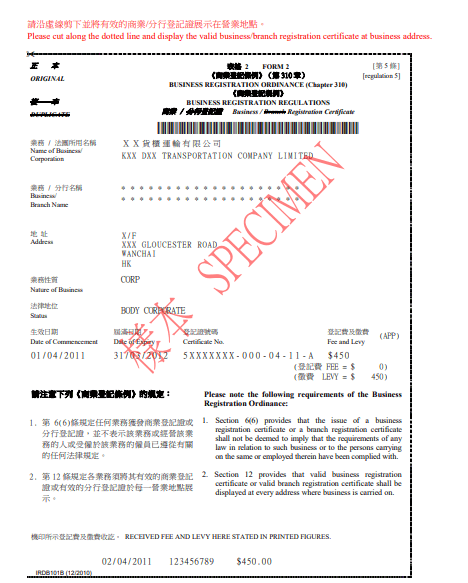

An essential document is the Business Registration Certificate. The first step is to incorporate your company, while making sure it follows the Companies Ordinance Guidelines. To start running the business, you must register for a Business Registration Certificate with the Inland Revenue Department (IRD).

Business Registration Certificate in Hong Kong

Before we can get into more in-depth details of BRC, let us look at the definition.

What is a BRC?

It is basically a document issued by the Business Registration Office containing the details of a company and is one of the major requirements for running a business in Hong Kong. If you have a business in Hong Kong, you must apply for a BRC within 30 days of initiating the operations. If the details of your business change, you must notify the Business Registration Office within 30 days to make an appropriate update on the registry.

A BRC accommodates the following details:

- The name of the business

- The Nature of business you are operating

- Address of the business

- Type of business

- Date of business commencement

- Expiration date

- Certificate number

You can check an available company name in Hong Kong on our website. After this, you may use it for the BRC.

The documents needed to prove your identity depend on the type of business you register, sole proprietorship or limited liability company. Prepare all your documents well before according to the type of your business.

What businesses require a BRC?

There are many investors who have one question that is always lingering in their minds, which is, “Does their business really require a business registration certificate?” To clear the confusion, given below, is the list of businesses that require a business registration certificate.

- Any type of organization or activity, which is done for the purpose of making profit. For example, retail commerce enterprises, professional services providers, and craftsmanship.

- Different clubs who offer services and facilities to its members by charging a fee.

- All companies that are incorporated in Hong Kong. Note that this includes those that do business in Hong Kong and other jurisdictions.

- All Hong Kong companies with representatives in Hong Kong, whether they have a registered address or not.

What businesses do not require a Business Registration Certificate?

There are certain exceptions in which you do not require a business registration certificate. If you are a person employed by an organization in Hong Kong, you are not expected to have a BRC. Therefore, you do not have to register for a business registration certificate. Activities from charitable organizations do not have business transactions and therefore, do not require a business registration certificate.

If you have a freelance job, you may not need to apply for a Business Registration Certificate. If your side gig grows in business, then you may want to incorporate a company to not only keep track of all your revenue and expenses, but also for taxation purposes that may end up being advantageous.

In several instances, you’ll find that some shop owners do not have to register their businesses, but they do need to have a license for operating in Hong Kong.

When do we register for a Business Registration Certificate?

When you incorporate your company, your business is automatically registered with the government. You may start running your business upon successful registration of the company. You register for a Business Registration Certificate when you are ready to do business in Hong Kong or the rest of Asia.

Let’s say you accidentally commenced business without registering it with the government. If you do not apply within one month and you are caught, you will be slapped with a severe penalty of HKD 5,000 and imprisonment for one year, as per the statement that is stated under the Business Registration Ordinance. Above all this, you would still have to apply for registration and pay the fees and levy for the current year including all the years you fail to pay. Therefore, it is best if you start your company and follow the procedure to register your business on time rather than taking the risk and getting caught by the government and having to pay severely.

What is a Business Registration Number?

On your Business Registration Certificate lies your Business Registration Number. This number is a unique identifier issued by the Inland Revenue Department to a registered enterprise. It is an eight-digit number on the certificate. When dealing with different government agencies in Hong Kong, you would need to refer to this number. You would also need it when filing annual returns.

Display Business Registration Certificate

Now that you have completed all the necessary stages of registering your business. This document must be displayed proudly at the business address or branch where your business is carried out. Even if the business registration certificate was issued to you electronically or online, you would need to print it out and display it in the office. One reason why it is important to display the BRC at all times is because at any time a HK government administrative officer can come by for an official inspection. If your BRC is not displayed at the office, you will be slapped with the aforementioned fines (and more). You must make sure to have this.

Penalties for Failing to have the Business Registration Certificate

On the off chance that you neglect to apply for a business registration certificate in Hong Kong, it is an offense that could result in heavy fines and prison terms. Plus, in case you apply for BR after over one year, the Business Registration Office will expect you to clear the expense for current recharging, all the charges for the years that you have not gone along, and any punishment that may be forced therein.

Renewal of Business Registration

Registered businesses will receive a renewal notice before anniversary date.

When and how should I renew my Business Registration Certificate?

The renewal of a business registration certificate can be done either face to face or by post as follows:

- Face to face – You should visit the Business Registration Office for your new certificate If your business address changed, then you must file an IRC 3111A and report it to the government.

- By post – You ought to send a copy of your old Business Registration Certificate with a crossed check made payable to “The Government of the Hong Kong Special Administrative Region” to the Business Registration Office. A new BRC will be presented at your place of work soon thereafter. If your business address has changed, you should also attach the new address specifying your business registration number, business name, old and new business address or registered office address, and the date of change.

How can Startupr help you?

Startupr is one of the leading business registration and incorporation providers in Hong Kong. We can help you to register your business in Hong Kong and get all the proper documents to set it up. We can also help you to renew your business registration certificate. It’s best to hire a professional to avoid mistakes. Visit Startupr in case you are searching for a reliable source who can help you in the business registration process. Contact us now!