You might have heard of companies paying dividends, but what is it? Well, a dividend is a form of payment made by the company to its shareholders. Dividend payments are the portion of the profit that the company chooses to distribute and reward their shareholders with — those who have invested in the company. So, is this the same for companies located in Hong Kong? Yes, the basic concept is the same. However, there are certain differences in the payment, tax, legal, and accounting procedures. In this article, we will highlight several aspects of dividend distribution in Hong Kong. Let’s get started!

Dividend payments in Hong Kong company

To begin, a dividend is basically a portion of the company’s profit that is distributed to its shareholders. This payment is usually paid periodically, based on the term, or as and when the company decides. A dividend payment in Hong Kong is generally paid twice in a particular year, while it may be paid quarterly or even monthly. Therefore, the mechanism of dividends works on the same concept in Hong Kong as that in other countries; however, there are some specific differences in the way the company pays dividends.

What are dividends?

Dividends are often defined as the share of profit that is paid to the shareholders of a company. It is mainly based on the profits earned by the company, and these profits are used to pay the dividend. Generally, the priority of the dividend distribution is based on the type of equity held by the shareholder. As a matter of fact, the amount of dividends can vary depending on the number of shares held and the company’s profit.

The primary purpose of dividend distribution is to provide a return on investment (ROI) to the shareholders and create a sense of optimism. This makes it a fundamental part of the company’s strategy and objective, thereby creating a healthy relationship between the company, its shareholders, and the investors. As a result, dividends are considered an essential part of the financial life of the company, and for many, a significant source of dividend income.

Types of dividends

There are various types of dividends, which can be classified in the following ways:

- Cash dividends – When the company distributes a cash dividend, it represents the existing shareholders’ entitlement to receive cash in proportion to the number of shares they hold. This amount is distributed as a cash payment or electronically transferred to the shareholders’ bank account. It is one of the most common forms of dividend distribution.

- Stock dividends – This type of dividend distribution works differently. When the company distributes a stock dividend, it means that the company is basically giving its shareholders additional shares. It is paid based on pro-rata, wherein it depends upon the number of shares that the shareholder holds.

- Asset dividends – This is another form of dividend payment based on the fact that the company distributes its assets to the shareholders. The assets may include physical, such as real estate, or any other assets, such as securities. In general, this is not a common form of dividend distribution.

How do dividends work?

The dividend distribution is generally paid out of the profit earned by the company. As the company grows and generates profit, the board of directors of the company may decide to distribute the profit to the shareholders, known as the dividends. In order to initiate the process and before the company pays its dividends, the board of directors must declare and announce the record date and payment date to their shareholders.

Are you wondering what these dates mean? Basically, the record date is the date on which the company determines the eligible shareholders, while the payment date refers to the date on which the company will actually make the dividend payments to its shareholders. The payments can be made in various forms, depending on the type of dividend distribution.

What are dividend payments?

The dividend payment is a process of distributing the profit that has been earned by the company to its shareholders. This payment is usually scheduled for a particular date, usually twice a year, especially in Hong Kong. The board of directors of the company is responsible for declaring a record and payment date. Depending on the type of security and the number of shares that are held by the shareholder. The distribution and the amount of dividends can vary. As a result, the shareholders are provided with a payment in the form of cash, stock, or assets.

Dividend tax in Hong Kong

When it comes to dividend tax treatment in Hong Kong, there is no such tax levied on dividends paid to the shareholders. Now, this may sound surprising to you; however, it is true that the shareholders are not required to pay tax on capital gains in Hong Kong. This means that when a shareholder receives a dividend, there is no tax to be paid on it. Therefore, it is considered to be a tax-free payment, which makes it especially beneficial to the shareholders. So, what is the process to pay dividends in Hong Kong company?

How to pay dividends in Hong Kong?

Now that you know how dividends are distributed, let’s look at how dividends are actually paid in Hong Kong. There is a slightly different process for paying dividends in Hong Kong as compared to other countries. The following are the steps involved in dividend payments in Hong Kong:

Step 1 – Create a Director Resolution

The first step involves creating a Director Resolution, also known as the Corporate Resolution or Board Resolution. It is a legal document from the directors of a company that authorises and records binding decisions and actions to the company.

This basically provides a framework for the company to run and function in an orderly manner. Whether it is regarding the distribution of dividends or any other business-related matter, the resolution ensures that it is in accordance with the laws of Hong Kong.

Don’t have a Director Resolution for your Hong Kong company? Check out our list of services or contact our specialist to prepare one.

Step 2 – Identify the payment method

The second step is to identify the payment method. After the payment of dividends has been authorised, the relevant parties need to decide how they want to distribute it. A dividend payment in a Hong Kong company is usually done in two ways; through a cheque or through an electronic funds transfer (EFT). Payment using a cheque typically involves additional costs, such as the cost of printing and delivering the cheque. This has led to the popularity of the EFT method of payment, which is quick, easy, and convenient. Whether the payment is made through cheque or EFT, the company can use either a Hong Kong bank account or a foreign bank account.

Step 3 – Declaration & make the payment

The third step involves declaring the dividend distribution to the Inland Revenue Department by filling out a declaration. This step is necessary in order to avoid any penalty or complication. Here is a list of details that are required for the declaration:

- Name of the company.

- Registered address of the company.

- Date of the dividend declaration.

- Details of the dividend payment – amount and currency.

- Names and addresses of the shareholders who are eligible for dividend payments.

- Mention the types of dividends – Cash/Stocks/Assets.

- Any other relevant information required by the Inland Revenue Department.

Further, when the Inland Revenue Department receives the declaration form, they assess and verify it. If the declaration form is in order, they will then immediately approve the same and send a dividend payment warrant to the company. As a result, the company is then able to make the payment of the dividend either by cheque or electronically.

Note: Companies are not required to declare dividend distributions to the Inland Revenue Department (IRD). However, if they transfer shares and have previously paid dividends, they must include this information in the share transfer form. In certain circumstances, a Hong Kong company must report this to the IRD (like in the case of a share transfer). Still, if you are unsure about which situations apply to you, please contact us.

Legal implications on dividends in Hong Kong

When it comes to the legal implications of dividend distribution, there are certain rules and regulations which the company must adhere to in order to avoid any penalty or consequences. Part 6 of the Companies Ordinance (Cap. 622) states that a company may only distribute money earned from earnings or profits that are accessible for distribution (s. 297 of Cap. 622).

Additionally, a company’s Articles of Association typically specify the terms and conditions for declaring and paying dividends. While it is essential to note that this legal implication is only referred to cash dividends. Let’s look at the following example: for instance, according to article 73 of the Model Articles for Private Companies Limited by Shares (Cap. 622H) the value of dividend should not be more than what is suggested by the board of directors.

Accounting treatment on dividends in Hong Kong

From the accounting point of view, the dividend payment in HK company is paid out of the surplus, which is the profit earned by the company, and thereby. They should not be reported in the income statement as a cost of the period. However, the journal entry is recorded in two instances, i.e., on the date the dividend is declared and on the date that the dividend is paid. Below is a brief description of the journal entry recorded in these instances:

- On the date of declaration of the dividend – Debit to a stockholders’ equity account known as ‘Retained Earnings’ and credit to a liability account called ‘Dividend Payable’. As soon as the board of directors declares the dividend, the equity section of the balance sheet shows a decline; however, the cash is yet to be paid in the form of a dividend.

- On the date of the actual payment – Similarly, the ‘Cash account’ (with credit) and the ‘Cash Dividends Payable’ account (with a debit) will be decreased. The total impact of the cash dividend is reflected in the balance sheet because the net result of these two transactions is a decrease in cash and equity. As a result, the accounting treatment of dividends follows a similar principle.

Note: Companies based in Hong Kong should report the details of dividends to the auditor during the annual audit process. Thus, companies should follow these rules as a standard practice.

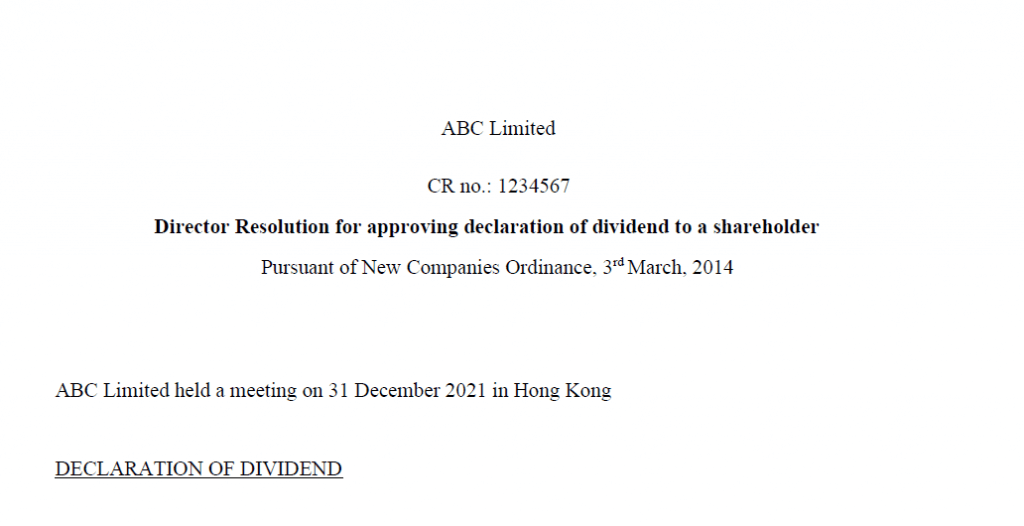

Now, the image below shows a sample of dividend resolution by a private limited company in Hong Kong. The purpose of the resolution is to inform the shareholders about declaring the dividend. This include the key details such as the date of dividend declaration, company name, CR number, and the place of resolution of the director.

Ask Startupr for help with Dividend Payments in Hong Kong!

As an employer, it could be difficult for you to adhere to various federal, state, and local laws and regulations. The best way to avoid any legal or regulatory issues with your company is to hire the right corporate services provider. At Startupr, we offer you the best and most efficient solutions, such as incorporation and registration of your business in Hong Kong, dividend payment in Hong Kong company, tax compliance, legal entity search, and formation services. To learn more about our corporate services and other solutions that we provide to our clients, visit Startupr now!

FAQ

Do you have more questions ? Read frequently asked question part or contact us.

How often are dividends typically paid in Hong Kong?

While it varies, dividends are often paid twice a year in Hong Kong, but can also be paid quarterly or monthly.

What are the different types of dividends?

Common types include cash dividends (cash payments), stock dividends (additional shares), and asset dividends (distribution of company assets).

Are dividends taxed in Hong Kong?

No, dividends paid to shareholders are generally tax-free in Hong Kong.

Do I need to declare dividend payments to the Inland Revenue Department (IRD)?

Not usually, unless there is a share transfer, or other specific circumstances. When in doubt ask a professional.

What legal implications are there for dividend payments in Hong Kong?

Dividends must be paid from available profits, and the company’s Articles of Association will outline specific rules.