Hong Kong Auditing of Accounts for Entrepreneurs

For business success, understanding every aspect of the process is crucial, and auditing your accounts is an integral part of that.

Have you set up a Hong Kong company, or are you just searching for the things that you would have to take care of when you open one? Either way, after you have set up a Hong Kong company, there are some things that you need to take care of daily as well as annually to follow the legal obligations, such as the financial statements, audit report, and annual return. For you to keep your company in good standing, it is vital to comprehend each thing involved in the process out of which auditing in Hong Kong is also a part.

Hence, let us dig into the nitty-gritty details of everything that is related to auditing, including the difference between auditing vs. bookkeeping and more.

Understanding Annual Auditing Reports for Hong Kong Businesses

Auditing Reports are written opinions of the financial statements of the business by an auditor. The Audit Report shows the financial health of a company, reviewed and confirmed by an independent third-party accountant. The annual audited accounts in a Hong Kong company might seem like some element of mundane accounting and taxation for any company in Hong Kong. But it is, in fact, something that has many far-reaching consequences. This is why it is being stressed a lot due to its importance as a yearly task for each and every Hong Kong business to undertake.

Three main things that have to be considered when opening the business and even running it in Hong Kong in terms of auditing:

- Hong Kong company registration – In this, you need to undergo a lot of legalities for opening the company, bank account, and submitting the appropriate documentation.

- Accounting & Tax – Preparing the yearly or quarterly accounts and filing them for the purposes of the taxes that have to be paid to the government.

- Annual Company Audit Report – In this, a CPA, also known as the Certified Public Accountant, is hired to audit the accounts of your business and then provide a report as to their accuracy, which would be used in the filing process later on.

Setting up a company is not the only task that needs some attention. The moment you start the business, it becomes essential to take care of it so that it can run in the best possible without getting into any unnecessary losses. This involves the process of properly keeping the financial accounts and preparing the audit reports.

What is Auditing?

An audit is an objective evaluation and examination of the financial statements of the organization to ensure that the records are an accurate and fair representation of the transactions. The auditing in Hong Kong is done by a person who is from outside the firm and hire specifically for this task. This task must be done by a Certified Public Accountant, who has passed the necessary exams and received the qualifications to practice accounting and prepare Audit Reports for companies.

The IRD would rely on the audits from a Hong Kong CPA to validate the accuracy of the return of the taxpayer or other transactions. These CPAs would take the time to thoroughly review the accounts, and offer their opinion on the financial statements of the company. Moreover, if the IRD finds inconsistencies or red flags in the financial statements, this is taken as a negative connotation that can be seen as an evidence of a kind of wrongdoing by the taxpayer. This is the reason why it is said to get the audit report prepared by a highly qualified professional Certified Public Accountant, even if it means paying more for better work.

Breakdown of Auditing in Hong Kong

- Who conducts the audit? Audits are performed by an independent third party, meaning someone not directly employed by your company. This ensures an unbiased and honest assessment of your financial statements.

- Why is an independent audit important?

- It helps identify material errors (significant inaccuracies) in your financial statements.

- It provides stakeholders with a reliable and accurate view of your company’s financial health, enabling them to make better-informed decisions.

- It avoids potential negative findings from the Inland Revenue Department (IRD) in Hong Kong, as inconsistencies or exaggerated numbers found by them are seen as a negative. It’s best to have your audit prepared before filing your profits tax return with the IRD.

- An external audit ensures honesty and doesn’t affect daily working relationships within your company.

- Audit frequency: Most companies undergo an audit annually, while larger companies might have quarterly reports.

- Legal obligations: For some companies, particularly publicly traded ones, audits are a legal requirement. This helps prevent fraud by identifying intentionally misstated financial information and can be used to assess the effectiveness of internal controls on financial reporting.

What Don’t Auditors in Hong Kong Do?

Do not confuse the external auditor with a bookkeeper, or do not mix their tasks as well. Other than this, there are many things that the auditors do not do, that have been shared below:

- Create an internal audit report on the information that is provided to the members of the company, for instance, the report of the director.

- Test the capacity of all of the internal controls of the organization.

- Thoroughly review every transaction carried out by the organization.

- Evaluate the appropriateness of the business activities or decisions or strategies of the organization that are made by the directors.

- Check every figure in the financial audit report – audits are based on careful testing and analysis only.

- Let the shareholders know about the quality of the management and the directors, the quality of the risk management controls and procedures of the organization, or the quality of the corporate governance.

What Can’t Auditors in Hong Kong do?

These auditors that you might be thinking of employing for your Hong Kong company can’t do everything for you. They have their limits, and what they can’t do is:

- Be there all the time – There is a time limit for preparing the audit reports, which means that the auditors are not in the company at all times. The fundamental purpose of the audit report is to develop an opinion about the information in the financial report recorded as a whole, and not to distinguish all the possible irregularities. In short, this just means that the auditors always look out for the signs of potential material fraud in a business, but it does not mean that all organizations have a fraud identified. In other words, auditors are watchdogs, not bloodhounds.

- Predict the future – Up till now, you might have become evident with the fact that the auditing in Hong Kong is about the specific accounting period that has passed, like a previous month or year audit report. Hence, it cannot be used for the judgment of something that has the chance of happening in the future. And this cannot offer the assurance that the organization would continue the business indefinitely.

What exactly Do Auditors in Hong Kong Do?

Well, the auditor’s work is to make a report on the financial situation of a company after analyzing everything in it. This is how it goes – they discuss the scope of the audit work with the organization, where the management or the directors might request some additional processes that need to be performed by the auditors for the auditing in Hong Kong.

The auditors sustain independence from the directors and the management so that the judgments and the tests are made objectively. The auditors are responsible for figuring out the extent and the kind of audit procedures that would be performed, which depends on the controls and the uncertainties that have been identified.

The procedures of Auditors might include:

- Asking many questions – A lot of questions would be asked by a lot of the organization’s members. These questions can be from the formal written questions to the informal questions asked orally.

- Analyzing accounting and financial records, other related documents, and the tangible items like the equipment and the plant.

- Making decisions on notable estimations or postulates that the management of the company made when they prepared the financial report.

- Getting a written confirmation on the particular matters, like asking the debtor to validate the debt amount that they owe the company.

- Testing a few of the internal controls of the company.

- Following particular procedures or processes that are being performed in the organization.

How is auditing in Hong Kong conducted?

There are some specific steps that are involved when we talk about the process of the auditing in Hong Kong or in any other country. These steps are:

- The management of the organization prepared the financial audit report. Also, it has to be prepared following the legal obligations and the financial reporting standards.

- After this, the auditors begin the examination by obtaining an understanding of the activities of the company and analyzing the industry and economic problems that may have affected the business during the reporting period.

- For each significant activity recorded in the financial audit report, the auditors recognize and evaluate any uncertainties that could have a substantial influence on the financial position of the company, and some of the measures for internal controls.

- Based on the uncertainties and restrictions identified, auditors estimate what management has done to make sure the financial report is accurate, and examine all the supporting evidence.

- After the audit reports are examined, the judgment is made by the auditors to check if the financial report is an accurate and fair representation of the financial results and financial position of the organization, as per the financial reporting standards.

- In the end, after all this has been done, the auditors make the audit report from what they understood by analyzing everything by sharing their opinion of the members or shareholders of the organization.

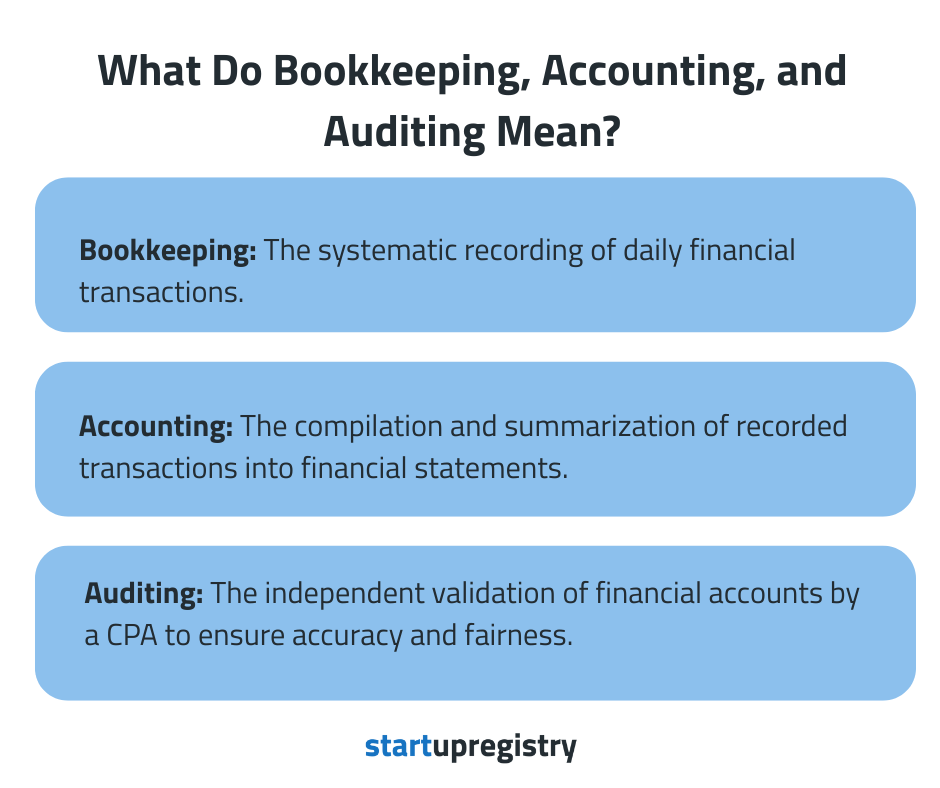

What do bookkeeping, accounting, and auditing mean?

It’s common to get these terms confused, especially in the context of Hong Kong business. While bookkeeping, accounting, and auditing are all related to your company’s financial health, they serve distinct purposes. They differ in terms of their focus, the people involved, and the level of analysis provided.

Here’s a clearer breakdown:

- Bookkeeping: This is the foundational step. A bookkeeper is responsible for the systematic recording of all daily financial transactions in your company’s ledgers and books of original entry. Think of it as meticulously logging every sale, purchase, and payment.

- Accounting: Building on bookkeeping, accounting involves compiling and summarizing these recorded transactions into comprehensive financial statements. An accountant takes the raw data from bookkeeping and organizes it into reports like profit and loss statements and balance sheets, making your company’s financial position understandable.

- Auditing: This is the final, independent step. An auditor (who must be a qualified Certified Public Accountant – CPA) then validates these financial accounts to ensure their accuracy and fairness. Their role is to provide an objective opinion on whether your financial statements present a true and fair view of your company’s financial performance.

Key Differences of auditing vs. bookkeeping (accounting) Summarized:

- Timing: Bookkeeping and accounting happen continuously throughout the financial period. Auditing begins after the accounting work is largely complete, usually at the end of the financial year.

- Responsibility: Bookkeepers and accountants are responsible for recording and compiling financial information. Auditors are responsible for checking, verifying, and analyzing that information.

- Role & Advice: An accountant provides financial information to management but typically doesn’t offer advice or opinions on the financial health itself. An auditor, however, analyzes the accounting records and provides an independent audit opinion.

- Independence: Auditors are independent third parties, which ensures their assessment is unbiased. Bookkeepers and accountants are usually internal or directly engaged by the company.

- Qualifications: While accountants need strong financial knowledge, auditors in Hong Kong must hold a CPA qualification.

In essence, bookkeeping records the financial activities, accounting organizes them into understandable reports, and auditing independently verifies the accuracy and fairness of those reports.

Choosing the Right Certified Public Accountant (CPA) for Your Hong Kong Audit

Now that you understand the different financial roles, let’s focus on finding the right auditor for your Hong Kong company. For auditing in Hong Kong, you’ll need a Certified Public Accountant (CPA) who is specifically accredited in Hong Kong to prepare your audit report.

While many agencies and incorporation companies offer these services, if you’re considering hiring an independent CPA, there are several crucial factors to keep in mind.

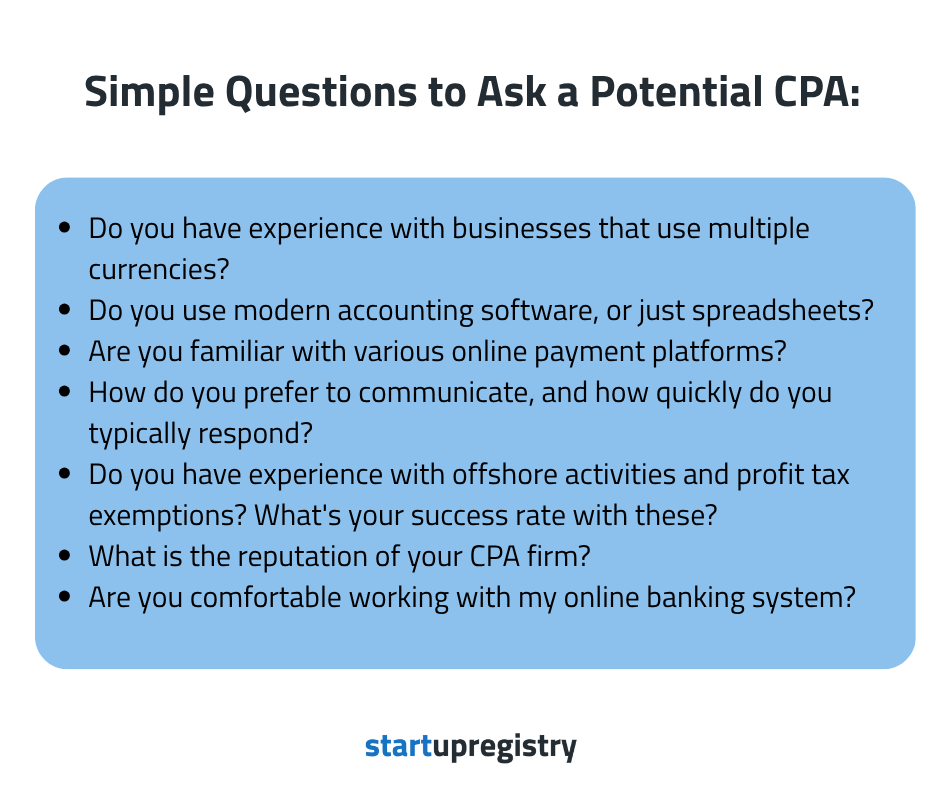

Key Questions to Ask When Hiring a CPA:

- Experience with Multi-Currency Operations: Have they worked with businesses that handle a wide range of currencies or manage multi-currency bank accounts? This experience can be vital for an accurate audit report, especially if your business operates internationally.

- Technology Proficiency: Do they utilize modern accounting software, or do they primarily rely on spreadsheets? Current accounting software significantly improves accuracy, efficiency, and information sharing.

- Familiarity with Online Payment Platforms: If your business has a high volume of transactions or uses various online payment platforms, confirm if your CPA is familiar with these systems. Not all accountants are, and this knowledge is crucial for a comprehensive audit.

- Communication Practices: How do they prefer to communicate, and what are their typical response times? Clear communication methods and timely responses are essential for a smooth working relationship.

- Offshore Activities Expertise: If your company has offshore activities, are they experienced with profit tax exemption claims and handling tax query letters from the Inland Revenue Department (IRD)? Many local Hong Kong CPAs might offer attractive prices but lack experience with offshore clients and complex tax matters. Inquire about their success rate for profit tax exemptions.

- Firm Reputation: What is the overall reputation of the CPA firm? For sensitive tax filings, such as profits tax exemptions, it’s crucial to choose a reputable firm to avoid increased scrutiny from the HK IRD.

- Comfort with Online Banking Systems: Are they comfortable working with your chosen online banking system? Ensure their technological comfort aligns with your operational methods.

This list offers a great starting point, but ultimately, trust and clear communication are key. Choosing the right CPA ensures a smooth audit process without unnecessary hassle. If you find this overwhelming, Startupr can appoint an independent CPA to handle your auditing and taxation needs.

Company’s Responsibilities for an Audit

Even though the majority of the work falls on the CPA to conduct the audit and taxation matters as per their standards, the company also has some duties and responsibilities for its own audit. In general, they should provide the relevant financial data and documents and communicate well with the CPA.

Here are some of the guidelines for the company’s responsibilities for the audit:

- Communication is key. Expect the auditor to ask a lot of questions about the accounts. Even though you may have a busy schedule, try to answer the auditor’s questions when you can. This is important to move along the process and finish the audit.

- Be willing to be transparent and offer a clear picture of the financials of the company. The last thing you want is the auditor to nearly finish the job, only to discover the company’s PayPal account, which you forgot to mention. This will delay the audit and may have consequences if you have important tax deadlines to meet.

- Don’t assume the job is done after payment. Accounting is a process, not a product. Even if the CPA is paid for the work, they cannot create the numbers from thin air. Thus, you will need to follow up with the relevant information as they ask.

- Importance of documentation. Like a lawyer cannot win a case without evidence, an auditor cannot verify figures without documents. Be sure to keep organized records of your documents, in case the auditor needs them to verify figures in the accounts.

- Realize that auditors are people too. Even if the process can be annoying at times, keep in mind the auditor wants to finish the task as much as you do. Be patient with the process.

These are some of the main responsibilities of the company, and although there are other points, this information will help you with the communication with the CPA and the audit process.

Audit Report, Tax Computation, and Tax Filing

After all the story about what auditing in Hong Kong is all about and how to hire the best CPA for the audit report preparation in your company, now let us understand why the report is needed. So, if you feel that you do not care about the report and you are okay with the way things are without the help of a bookkeeper, accountant or an auditor, it is essential to understand that the government cares since these things are what would be used to file the taxes of your company.

Yes, that is why the topic has been stressed a lot! Let us comprehend the ongoing statutory compliance and the annual filing requirements for the Hong Kong private limited companies that have been explained in brief below. With this, you would know why there is so much fuss about the difference between auditing vs. bookkeeping, as well as the audit report in a company.

Basic Ongoing Compliance Requirements

At first, let us see what the activities are that a company has to follow, which are related to the tax filing and auditing in Hong Kong. In terms of the obligations of auditing in Hong Kong, a private limited company needs to:

- Keep an appointed auditor unless it is an organization that is considered “dormant” as per the Companies Ordinance. A dormant company is one that has no accounting activities during a financial year.

- Keep the following documents and records at all times: share certificates, updated financial records, audit report, minutes of all the meetings, registers that include the share register, and the directors’ register prepared by the bookkeeper.

- Follow the annual accounts filing requirements and the deadlines of the Companies Registry and the Tax Authority of Hong Kong.

- Keep detailed and accurate accounting reports and the audit report to enable the assessable profits of the company to be immediately determined. All records must be retained for the next seven years from the date of the transaction. This is something that the bookkeeper takes care of. These reports are then used to get the auditing in Hong Kong done.

And for this, the directors need to record the financial accounts of the company that include the Profit and Loss Account, as well as the Balance Sheet in compliance with Hong Kong’s Financial Reporting Standards (FRS) framework. This is where the auditing in Hong Kong enters a company for the audit report to be prepared in connection with the annual accounts.

Filing of Annual Tax Return with the Inland Revenue Department (IRD)

The IRD notifies the company about the Tax Return filing on the 1st April of each and every year, and for those companies that have just been incorporated, they get the notification on the 18th month after the date of incorporation. It is expected that the companies should file their tax return within one month from the day on which the notification was given.

The companies can easily request the extension of the filing if it is needed. But if there is a failure to submit the tax return before the due date, there may be massive penalties placed in terms of payments or even prosecution. Also, while the filing is done, the following documents have to be attached as supporting documents:

- A tax computation showing how the amount of assessable profits or the adjusted losses was arrived at.

- The balance sheet of the company, the audit report, and the profit & loss statement relating to the basis period.

If you are still not clear about this and want to understand more information about the filing of taxes, you can refer to the next section, which focuses on the filing of taxes for your company. We will explain in more detail on how to file taxes in Hong Kong, which tax deductions and allowances you may apply for, and much more.

Ensuring Compliance in Hong Kong with Startupr’s Expertise

In case any of the above reports and documents are not kept, the company and the directors may face a penalty. Also, in case the accounting reports are out of Hong Kong, the returns have to be present in Hong Kong as outlined by the Financial Reporting Standards (FRS) framework. This has also been modeled on the International Financial Reporting Standards (IFRS) and issued by the International Accounting Standards Board (IASB).

Now, you can see why it is a big deal. You do not need to do something that the government has not made compulsory, but the other things have to be fulfilled as per the rules like the auditing in Hong Kong for the company. If you feel that you are not able to handle all these things, then you can take the help of an agency that is an expert in this like Startupr. We can help with the bookkeeping of the company, and appoint an independent CPA to deal with your company’s audit and tax filings.

Last update: June 2025