Capital Gains Tax in Hong Kong

Capital gains tax is a tax imposed on the capital gains or the individual’s profit through the selling of the asset.

Taxation on business operations within the territory of Hong Kong has become one of the most common queries among entrepreneurs. To be more precise, taxation of gains on the sale of shares or assets has been a gray area for a long period of time. Hong Kong doesn’t impose any capital gains tax on the selling of assets.

However, gains on the asset’s disposal may be subjected to profits tax when the disposal constitutes a transaction in the nature of trade. If you are also dealing with this dilemma, we have got your back covered. This article will explain from head to toe about capital gains in Hong Kong. Let’s dive deep to gather more information about capital gains in Hong Kong.

Capital Gains Tax in Hong Kong

Capital gains tax is a tax imposed on the capital gains or the individual’s profit through the selling of the asset. This tax is only imposed when the asset transaction has been completed, not at the time when it’s in the investor’s hand.

What is Capital Gains Tax in Hong Kong?

Capital tax is defined as the tax levied on the difference between an asset’s selling price and its original purchase price. It is considered to be realized when you sell the assets. A capital gains tax is classified into a short-term capital tax and a long-term capital tax.

As profits are categorized into ”income”, the capital gain is subjected to taxes. However, in Hong Kong, it would be subjected if the disposal constitutes a transaction in the nature of trade.

Let’s take an example to understand the concept

Mike Stallon bought stock worth $100 in February 2020, but now, on October 10, the stock’s value has been increased to $300. As per the concept, the capital gain is the difference between the asset’s value over time and its basis.

The basis is the actual cost of the stock for Mike: the sum of commissions, and fees, purchase price less any depreciated value of an asset over time. When he sells the stock for $300, then the $200 would be said to ”realized”. However, if he put a hold on the stock, the capital gain would be considered as “unrealized”.

Types of Capital Gains Tax

As the name suggests, the capital gain is the profit earned from the sale of any capital assets. This type of gain can be accrued either in the form of sale of investment or any real estate property.

According to the requirement of the duration, capital gains can either be considered as long-term or short-term. Profits earned from businesses are categorized as ”income”, so they are liable to pay taxes, which is known as capital gains tax. However, in Hong Kong, business owners don’t have to pay taxes for a capital gain, except the transactions that are trade in nature.

Short Term Capital Gains

Holding of an asset for less than 36 months would be termed as a short- term asset. For immovable properties, the duration is accounted for 24 months. The profit derived from the sale of these types of assets would be treated as a short-term capital gain. According to stock or asset types and the duration, the short-term capital gains would be taxed accordingly.

Long Term Capital Gains

Any type of asset held for over 36 months is known as a long-term asset. The profit derived from the sale of such an asset would be recorded as long-term capital gain. The assets such as Mutual funds, preference shares, equities, and zero-coupon bonds are also known as long-term capital assets when it is held for over a year.

Capital Gains vs. Business income

After going through the concept of capital gains tax, you must be looking for clarification between capital gains and business income. When a gained profit would be treated as capital gains, and when it would be considered a business income.

What’s the difference between Capital Gains and business income?

Which income would be realized as business income or capital gain? The distinction between these two terms plays an imperative role in operating the business adequately. For income that is capital in nature, a 100% deduction is allowed in Hong Kong. That’s why it is wise to figure out the exact type of income to minimize your tax payable.

Here are three things to keep in mind:

- Normal Business Transaction: If the transaction is quite similar to the business’s normal course, it may be considered a business income.

- Transaction’s Frequency: If a certain transaction is more and more frequent in the business transaction, the gain would be considered as business income; otherwise, it would be recorded as a capital gain.

- Nature of the Trade: The trade’s nature can also help identify the tax type from business income or capital gain. If the trade is an “adventure in the nature of trade”, then the gain will be fully taxable.

How does Capital Gains Tax in Hong Kong work?

The business friendly capital gains tax in Hong Kong is the main reason this city can maintain its status as an international business hub in both Asia and the world. The city does not impose a capital gains tax, whether in areas such as interest income, dividend income, or capital gain arising from the sale of assets.

However it’s important to consider whether the income being declared is indeed from capital gains and not arising in the normal course of business for the company.

How do I declare Capital Gains Tax for my Hong Kong company?

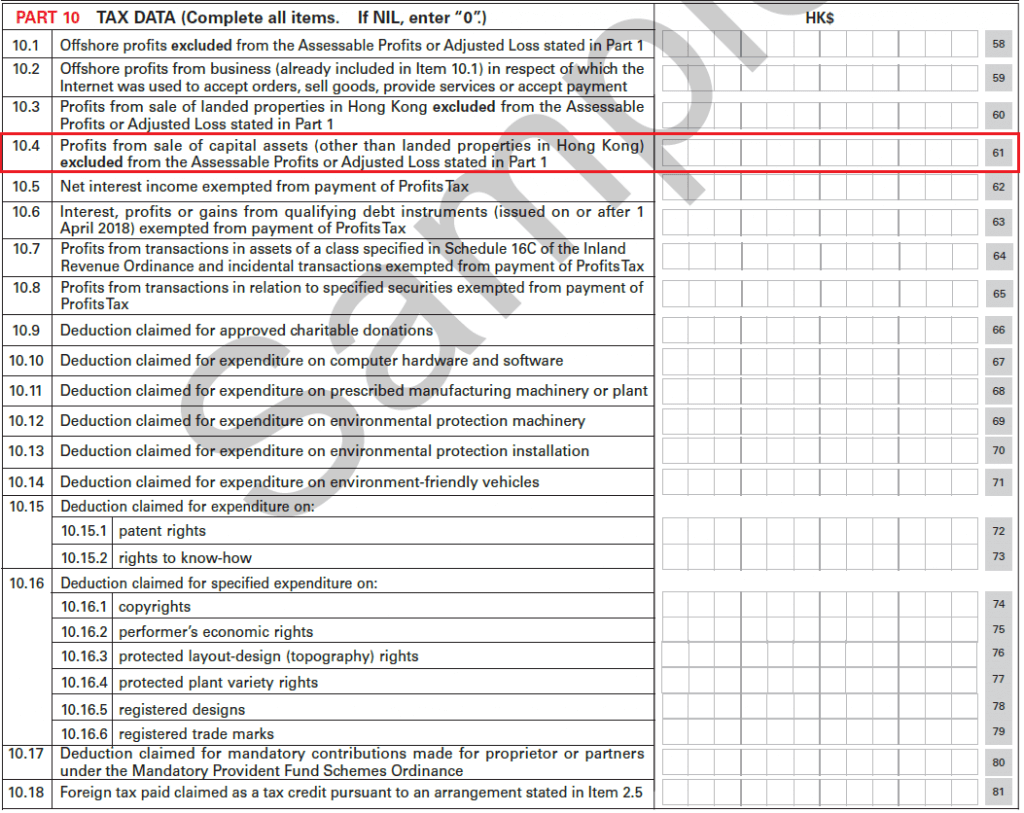

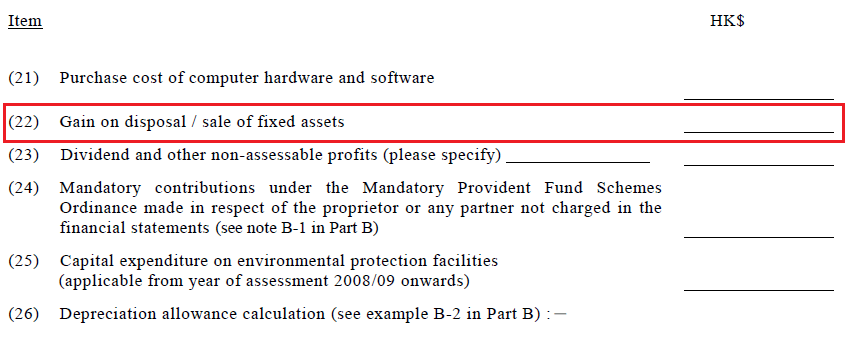

Capital Gains Tax for a Hong Kong company (being that arising from the sale of capital assets) works as similar to other types of income, and should be both recorded in its accounts and declared in the tax return. In the company’s Hong Kong tax return, the total amount of capital gains would be declared as tax deductible in the Tax Data section, part 10.4

However, be sure to note that any amount declared as tax deductible for a Hong Kong company can be subject to scrutiny by the IRD, so be sure to fill out this section carefully and have sufficient documentation to support your figures.

You would also need to declare the capital gains on the tax computation as well.

As most if not all financial statements are audited by a Hong Kong CPA, it’s better to communicate with them about the amount you wish to declare as capital gains and if your classification of this type of income is correct within Hong Kong tax regulations.

To quote the IRD on this:

Profits arising from the sale of capital assets are excluded from the charge of profits tax. Capital profits or losses, if any, recognized in profit or loss will be excluded from the computation of assessable profits… Whether the asset is of a capital or revenue nature is a question of law and all the surrounding circumstances, including the accounting treatment, have to be considered.

You should also be aware of all the audit requirements in Hong Kong and what obligations the company has towards keeping proper documentation.

How do I declare Capital Gains Tax for Hong Kong individuals?

Capital gains tax for Hong Kong individuals is not a great concern for most people in the city, as this amount is not required to be declared in their tax returns nor taxed. Therefore any amount gained from capital sales, stock investments, bond investments, or even gambling at the local horse races is completely tax free.

For this reason alone, Hong Kong is often seen as a financial hub for investments in Asia, and reduces a lot of red tape and regulations for both companies and entrepreneurs looking to do business in the city.

Need help with Capital Gains Tax in Hong Kong?

This article is all about the capital gains tax in Hong Kong, and how it differs from the business income earned in Hong Kong. If you need any professional assistance in dealing with the taxation policy, head over to Startupr. We will be happy to help you with filing and completing your tax documents.

Being one of the leading business incorporation and accounting service providers in Hong Kong, Startupr can provide you assistance in any accounting or taxation matters you may have in regards to your company, or future business transactions. For more information, contact us today!