Once you’ve set up your business, there are a lot of things that you’ll need to take care of. Accounting and bookkeeping for Hong Kong companies are among some of the most crucial activities needed to run a business. Great bookkeeping helps in maintaining the day-to-day accounts and auditing financial statements that are used in the annual returns. In fact, as per the Hong Kong government, you need to have your bookkeeping on point in case of any unexpected audit. This article clarifies everything you need to know about bookkeeping services, why businesses need them and all the legal aspects of bookkeeping in Hong Kong.

Bookkeeping for Hong Kong Businesses

When you think about bookkeeping, you might think of it as just spreadsheets and numbers. But it’s not always the case. Bookkeeping is a detailed task of recording every financial transaction that a business makes over the financial year. Doing this will increase your business success since you have an accurate view of the company’s performance right in front of you.

What is bookkeeping?

Bookkeeping for a Hong Kong business is the process of tracking and recording all the financial transactions that happen in the company on a daily basis. Each business activity is documented following the accounting principles and supporting documentation of the company. Some examples of these documents are:

- Purchase orders

- Invoices

- Receipts

- Bills

There are different ways of bookkeeping in Hong Kong. Some companies record their business’ transactions on an Excel spreadsheet, some record them in a journal, and some others stay up-to-date with technology using bookkeeping software programs that keep track of everything. However you decide to manage your books, if done properly, you will be able to monitor your company’s financial potential and work towards a successfully growing business.

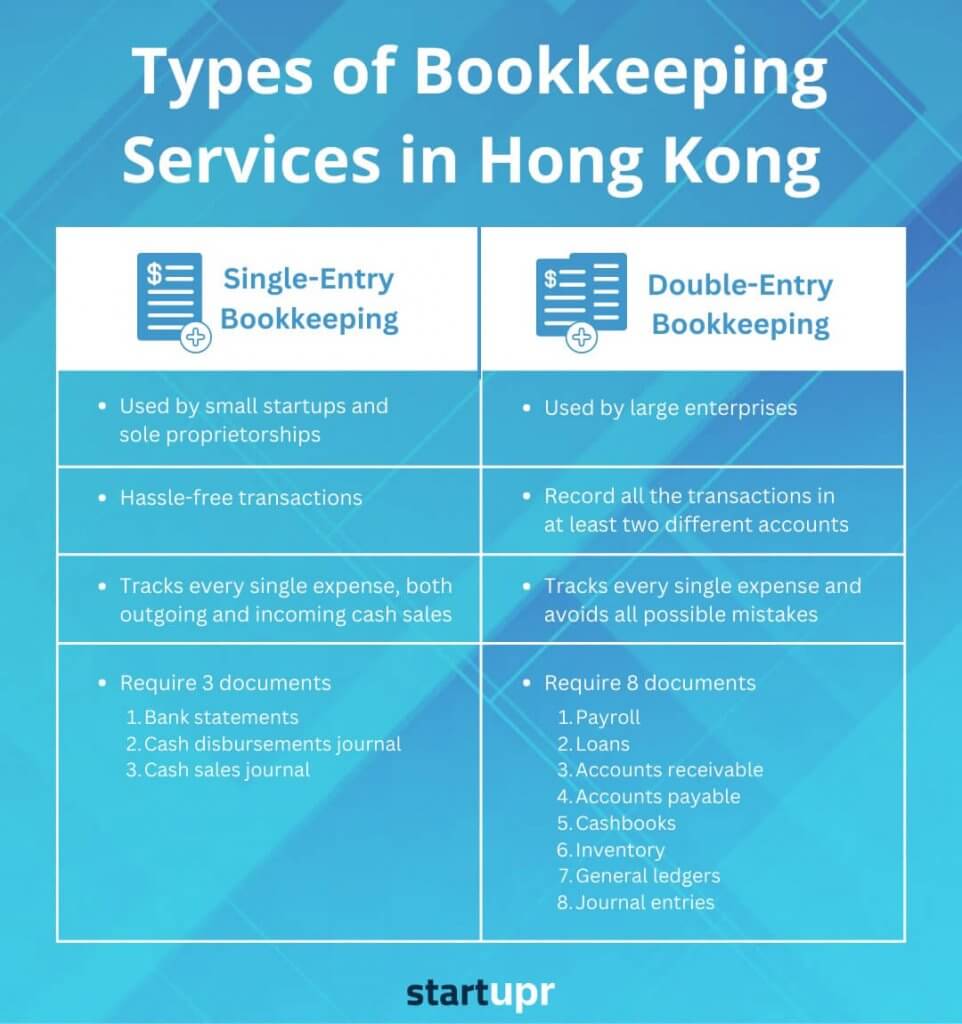

Types of Bookkeeping Services in Hong Kong

There are two main types of bookkeeping systems in Hong Kong, each of them with its related benefits. Let’s analyse the two options together, and figure out which one would best fit your business.

- Single-entry bookkeeping – This method is great for small startups and sole proprietorships with minimal and hassle-free transactions. It tracks each single expense, both outgoing and incoming cash sales of the company, on one single journal. If this works for your case, you’re gonna need to keep these three documents up-to-date:

- Bank statements – every entry made needs to be in alignment with the bank statements of the company.

- Cash disbursements journal – a detailed book that records all the expenses of the business.

- Cash sales journal – an internal book that records all the revenue that the company makes.

- Double-entry bookkeeping – Under this practice, all the transactions are recorded in at least two different accounts, showing as credit or debit. This method is mainly used by large enterprises that have accrued expenses and want to avoid all possible mistakes, given the double-record of all company’s movements. Here’s a list of all the documents needed for the double-entry system:

- Payroll

- Loans

- Accounts receivable

- Accounts payable

- Cashbooks

- Inventory

- General ledgers

- Journal entries

How does bookkeeping differ from accounting?

Even though bookkeeping and accounting might seem to be the same thing, they are not, and we’ll explain how. In a nutshell, bookkeeping is just one part, or service, involved in the broader accounting process. To expand on that, accounting is the generic term that refers to all those processes related to recording financial transactions of a company and using them to make better business decisions, whilst bookkeeping is a singular specific service within the accounting area. Substantially, bookkeeping strictly focuses on the full financial history of the company, whilst accounting will work with this data to work on better business growth strategies. That is why the two complement one another.

| Common Examples of Bookkeeping | Common Examples of Accounting |

|---|---|

| Processing payroll | Filing relevant tax returns |

| Preparing financial statements | Performing audits |

| Posting debits and credits to a journal | Preparing adjusting entries |

| Recording financial transactions | Reviewing and analysing financial statements |

Insider tip – check out two of the best and most popular accounting softwares people use in Hong Kong: Xero and Quickbooks!

Why is Bookkeeping important for a Hong Kong business?

It is clear that proper and well-maintained bookkeeping drives your business toward success. Bookkeeping for your Hong Kong company is a crucial part of the accounting process. Without this, you will not be able to improve the core areas of the business.

Keep reading to know more about why and how Startupr can provide your company with the best bookkeeping services in Hong Kong. Check out our competitive prices and many other Hong Kong services available here.

#1 Helps track financial performances and make better business decisions

By recording all the transactions of the company, you’ll have access to all the financial data you need to make important decisions or for any critical task. Usually, bookkeepers would section the transactions according to different categories, some of the most common ones are here as follow:

- Taxes

- Wages

- Services

- Goods

The bookkeeping service is also in charge of stipulating the company’s financial reports, which will offer accurate indicators of your company’s measurable success, as well as help you create strategic plans setting realistic objectives. On the other hand, financial statements are a great asset to help identify any problems in the business. With well-maintained bookkeeping for your Hong Kong company, you will be able to determine any disparities between what has been recorded and the financial statements. It will help you catch any errors that can become a massive obstacle down the road.

Some key documents in the financial statements that will help in the decision-making process include:

- Cash flow statements

- Income statements

- Balance sheets

#2 Good bookkeeping can help you save money on taxes

Each Hong Kong business has to pay its taxes to the Inland Revenue Department (IRD) at the end of every financial year, by completing and submitting the Profit Tax Return (PTR) form within three months since its receipt. Very important is that the PTR should clearly state every transaction that took place in the first 18 months of the business trading since its incorporation. By relying on an external company that keeps your books and records up-to-date, you don’t have to worry about all the stress and chances of making mistakes during the tax filing process. It is worth noting that failing to pay your annual taxes, or doing it wrong, can lead to monetary penalties or in more serious cases can end up in court. Hence, it’s always better to have your bookkeeping taken care of from day one of your business.

As per the government, the company needs to have the following records:

- A detailed record of all the money spent and received, with supporting details.

- A record of all the business expenses, income, assets, and liabilities.

- Supporting documents of all types of income, including vouchers, bank statements, receipts, and relevant papers.

- Journals that keep track of all the business’ receipts and payments.

#3 Provides a detailed history of transactions and can be used as evidence in legal proceedings

Bookkeeping for your Hong Kong company means that you have a detailed history of every transaction of the company. So, in case of any possible challenge from either another company, a client or perhaps the IRD against any of your company’s transactions, by keeping an organised bookkeeping, you will have the proof you’ll need to show your business’ legitimacy as evidence to legal proceedings.

Hong Kong has specific bookkeeping requirements that must be followed

There are many bookkeeping-related obligations that a company has to follow as per the Hong Kong’s government, and that is only possible by maintaining proper bookkeeping of all company transactions.

The main legal obligations are listed for you below:

- As per the Company Ordinance, every Hong Kong incorporated company has to have a registered auditor unless it is a dormant company.

- The government needs to be notified within 15 days if the company’s statutory books are being moved from the registered office to another location.

- The company has to notify, strictly within one month period, when new shares are allotted.

- The directors of the company are required to share the financial accounts of the company that follow Hong Kong’s Financial Reporting Standards framework during the annual general meeting (AGM).

- The company has to comply with the annual tax report’s deadline, according to the rules set by the Companies Registry and Tax Authority.

Professional Hong Kong bookkeepers are essential for annual audits

As mentioned earlier, every Hong Kong company needs to have a proper record of all the transactions of the business to comply with the Financial Reporting Standard framework required by the Companies Ordinance. To avoid any possible mistakes and legal persecutions, hiring a professional bookkeeper is your best solution. The designated bookkeeper will ensure your books are kept up to date and in compliance with local regulations, and will carry out annual audits of the company’s yearly financial statements on your behalf.

So, it would be best if you didn’t handle your own bookkeeping process, unless you are a certified bookkeeper registered in Hong Kong, to avoid possible mistakes. This is because the bookkeeper needs to be well-versed with all the requirements set by the Hong Kong government. If you are not familiar with the federal and local tax codes, may cause more trouble for your company than actually helping it, and even all the available tools won’t be able to help much.

We, at Startupr know how hard it can get being a business owner. Most of the time you will have lots of things on your plate, and thinking of growing your company is at the top of your list. The last thing you want to do is worry about bookkeeping. So, get in touch with us today, to know more about our many company registration services including professional bookkeeping and accounting!

How to find the right bookkeeping service for your Hong Kong business?

A bookkeeper is a very important hire for any company. They help you stay in line with the law and have your back in case an issue comes up regarding any company transaction. If you hire a bookkeeper who is not right or has no certification, it can take your company off the rails.

To help you hire one of the best bookkeeping services in Hong Kong, here are some key factors that you need to keep in mind:

- Experience – This is an obvious one. A bookkeeper holds the company together. You don’t want to pick someone who just got into the business. Hire someone who has adequate experience and has worked with companies like yours before. The perfect fit needs to have extensive knowledge of your business’ industry and how to make things easier for you.

- Aptitude for technology – Nowadays it is nearly mandatory for a good candidate in any field, to be great with technology. In the specific case of bookkeeping, it’s important because you can then get bookkeeping software to help make the process smoother. The person should also know about some basic accounting tools, billing systems, and Excel.

- Training and education – Don’t just go with a booksmart. A valuable bookkeeper will have the right education, certification, and training. In short, they should have it all. Having a degree is not important if the candidate doesn’t have any training or field experience, and can make room for errors (which should be close to zero in bookkeeping).

- Attention to detail – As we mentioned in the above point, there should never be room for mistakes in bookkeeping. So you are looking for a person with a keen attention to details that is able to identify any errors that can cause issues in the future.

- Tax preparation and planning – You will want to hire someone that is familiar with the whole Hong Kong tax system. Since this person will be the one helping you during the tax season by filing your annual reports and tax returns, you need someone you can trust with this. Although it is advised to use an accountant for this, you will still need a great bookkeeper since they help with the initial process.

Once you find someone or an agency, like Startupr, who has all these qualities and can help you with your bookkeeping, you can move ahead and hire them.

Why choose Startupr for your bookkeeping?

By now, you might have a better understanding of what bookkeeping is all about and why it is a crucial part of every company. If you want to be in compliance with all the rules set by the Hong Kong government, you will need the help of a professional. Startupr can help you with bookkeeping for your Hong Kong company. Our services vary from company registration to accounting and bookkeeping services in Hong Kong.

Our team is made of professionals only, who are looking forward to helping you manage all the financial statements of your business. We also help file all the important documents so you can focus on growing your company. For more information, contact us today!