Tax compliance in Hong Kong is crucial to avoid legal issues, hefty fines, and potential business deregistration. Staying compliant ensures smooth operations, peace of mind, and builds a strong business reputation. In this article, we’ll briefly cover the importance of compliance, penalties for tax evasion, and practical strategies to help you stay on the right side of the law.

Why is Tax Compliance Crucial in Hong Kong?

Hong Kong’s tax regime is widely praised around the world. It operates on low rates and simple taxation methods, which result in easy understanding and straightforward calculations for the taxpayer. Hong Kong follows a territorial tax system, which means that only income generated within the city can be taxed.

Enhanced Tax Compliance with Simplicity

By using this tax system, businesses can save any revenue from taxation that is generated outside Hong Kong. As the tax system in Hong Kong is beautiful and simple, it enhances tax compliance and reduces tax-related crimes. It is essential to note that simplicity does not equate to lax enforcement. Hong Kong has stringent laws and regulations regarding tax compliance. It keeps a good eye on the tax procedures to reduce the chances of failure in tax collection.

The Role of IRD

The Inland Revenue Department (IRD) is responsible for taxation in Hong Kong. It administers and enforces the tax laws in the jurisdiction. The IRD plays a crucial role in managing Hong Kong’s tax system. It makes tax compliance in HK essential for taxpayers and eliminates potential lapses in the system.

What Are the IRD’s Powers?

- Can demand records and documentation from businesses.

- Has the authority to audit, assess, and prosecute.

- Ensures transparency and accountability in the tax system.

Why Should Businesses Prioritize Compliance?

- Avoid legal troubles and penalties.

- Build trust with tax authorities.

- Ensure smooth operations and long-term credibility.

Hong Kong Tax: Consequences of Non-Compliance

Businesses and individuals in Hong Kong can face severe consequences for non-compliance with tax regulations. It is important to remember that consequences vary by severity but are always unpleasant for the operations and reputation. The punishment is entirely based on the seriousness of the offense, the amount of tax undercharged, the duration of the offense, and the degree of cooperation with authorities. IRD fines for late tax filing in Hong Kong can range from minor penalties to even imprisonment.

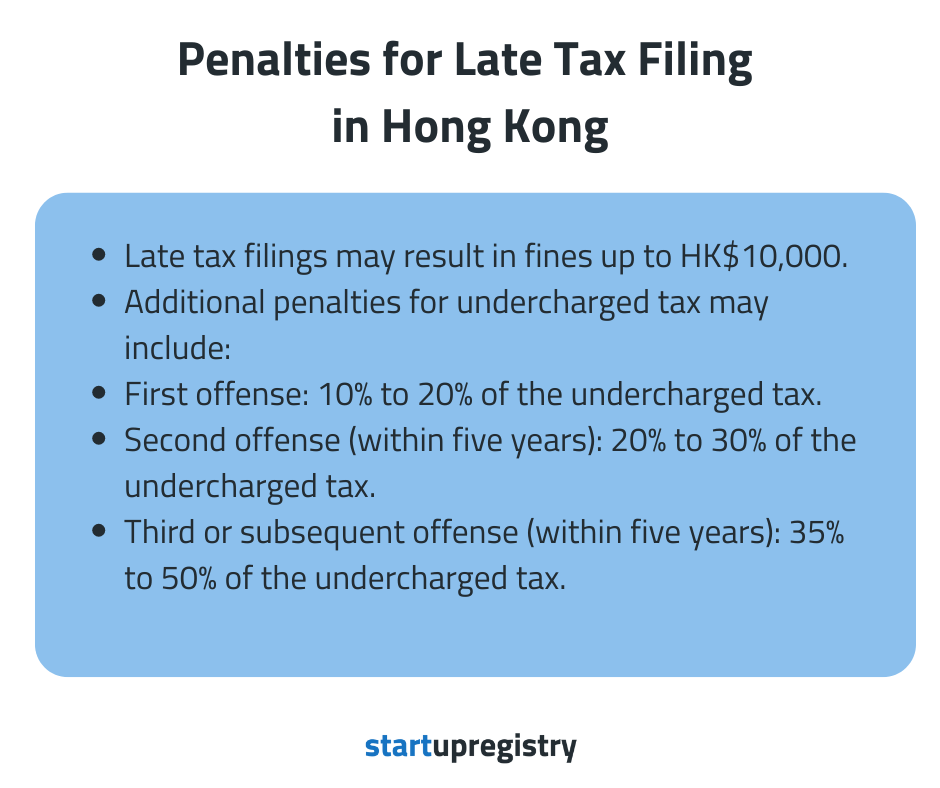

Penalties for Late Tax Filing in Hong Kong

Late tax filings may result in fines up to HK$10,000. Additional penalties may include 10% to 20% of the undercharged tax for the first offense, 20% to 30% of the undercharged tax for the second offense within five years, and 35% to 50% of the undercharged tax for the third or subsequent offense within five years.

Defaulting on Tax Payments

If a taxpayer is unable to pay taxes by the due date, the IRD labels that tax as in default. If the first instalment is not paid by the due date specified in the notice of assessment, the second instalment will become due immediately.

The Commissioner of the Inland Revenue Department can begin the debt recovery process if the tax is unpaid. They can impose a 5% surcharge on the overdue balance, which can escalate to 10% if the amount remains unpaid for six months.

IRD Recovery Actions

The IRD can also issue recovery notices to third parties who owe you, such as banks or customers. This forces them to remit your funds directly to the IRD. The IRD can also remove your name from the tax list, freeze bank accounts, and seize properties and other assets. It can also lead to restrictions on your ability to leave Hong Kong.

Intentional Tax Evasion

Intentional tax evasion is a grave offence in Hong Kong. It may lead to severe penalties under the Inland Revenue Ordinance. The actions that are included in this are deliberate tax evasion, providing false information, making false entries in taxes, and falsifying documents.

All these actions can result in huge fines and imprisonment. Under Sections 80 and 82 of the Inland Revenue Ordinance, hefty fines and prison sentences of up to several years can be imposed for intentional tax evasion.

How to Stay Compliant with Hong Kong Tax?

If you are considering how to avoid tax penalties in Hong Kong, the straightforward answer is to remain compliant. The best practices for staying compliant with Hong Kong taxes are outlined below.

Maintain Accurate Records

Businesses should maintain accurate and detailed records of all the company’s finances. They are required to keep meticulous track of all income, expenses, invoices, and bank statements. Keeping accurate records not only helps you in tax filing but also strengthens your position in IRD reviews.

Timely Filing

Tax filings should always be completed before the deadline. You can also request extensions if needed or possible. Businesses should submit tax returns promptly to avoid legal charges or fines. Timely filing demonstrates your credibility to the authorities and helps you avoid heavy penalties and prosecution.

Prompt Tax Payment

Businesses should always pay all their tax liabilities in full and on time. This can help them avoid surcharges and interest on unpaid taxes. They should ensure that they meet payment schedules to prevent automatic penalty escalation.

Seek Professional Advice

If tax filing involves complex situations, you should seek professional support. Consulting a qualified tax advisor or tax assistance in Hong Kong can help you understand and comply with relevant laws. They have several years of experience with the laws and regulations, which can minimize the risk of inaccuracies in filing.

Smart Tax Moves in Hong Kong

Hong Kong is known for its transparency and adherence to the rules. Businesses that file taxes accurately and on time are generally safe from any kind of scrutiny from tax agencies. Filing taxes within deadlines also helps you maintain good standing with the Inland Revenue Department (IRD). Mistakes or delays in tax filing or payment can result in substantial fines and penalties. Moreover, it can also result in imprisonment in severe cases, like intentional tax evasion or providing forged documents.

If you want to be safe from any kind of legal dispute, fines, penalties, or imprisonment, it is wise to file taxes on time and provide accurate documents and financial records. Strict tax compliance in Hong Kong helps avoid fines and legal issues, ensuring smooth business operations. The best strategies for staying compliant with tax regulations in Hong Kong include maintaining accurate records, filing taxes on time, making prompt tax payments, and consulting with tax professionals.