With the way businesses are changing, it has become crucial for founders to manage all the shares in the company and keep track of their cap table. And even though a cap table is simple in the beginning, as the company grows, it becomes more complex. Due to this, you shouldn’t keep your cap table in an excel sheet or manually keep track of the shares, as it can lead to a lot of mistakes down the line. The best way to go about this is by getting great cap table management software to do the work.

Let us understand all the aspects of a cap table and how you can create one using the right cap table software.

Cap table for Hong Kong Company

Every company needs to have a place where they save all the data about the company’s shares. That is where a cap table comes in. Let us understand what a cap table is in detail.

What is the cap table?

A cap table, which is also known as a capitalization table, is a simple table or spreadsheet where the company lists down all its securities. These securities can include common shares, preferred shares, options, warrants, preferred shares, and convertible securities. Other than this, the table also holds the details like who owns these securities and the prices paid for each. It also shows the ownership percentage of each shareholder in the company, the value of the securities, and how possible dilution of the ownership occurs over time.

When a startup is created, the cap table is usually made first, along with some of the primary company documents. And after some funding rounds in the company, the cap table becomes more complex. This is because it would now list potential funding from investors, mergers and acquisitions, initial public offerings and other transactions. But that’s not all.

Besides recording the company’s transactions, a cap table also holds all the legal documents, including the conversion of debt to equity, stock cancellations, transfers and issuances, and more. Due to the cap table’s complexity, it is vital to use a cap table management software to track everything properly. And creating a cap table using an excel sheet wouldn’t be enough. In fact, cap tables are used by venture capitalists, investment analysts, and entrepreneurs to analyze essential events, including the issuance of employee stock options, issuance of new securities, and ownership dilution.

Why is a cap table important for your Hong Kong company?

Cap tables are very crucial for a Hong Kong company since they let you know how much of the company you own. This can affect everything from how you price your future fundraising rounds to who needs to sign and control all the company’s major processes. It acts as a roadmap to help founders in the company plan how to arrange the future share issuances and the next steps to grow the company.

How do I create a cap table?

When you want to create a cap table, the first thing most companies do is start with an Excel sheet. In fact, many companies use spreadsheets to create a cap table when they open their new company. Wherever you create the cap table, it has to be designed in a simple and organized way where it clearly shows who owns what kind of shares, how many shares, and the total number of outstanding shares.

There are three ways through which you can create a cap table:

#1 Using excel sheets

If you are going to create a cap table using Excel, you will not be able to add all the details in one sheet, as it would become complicated. In fact, the most common structure that companies use is a list of the names of security owners/investors on the Y-axis, and the type of securities on the X-axis.

Alternatively, some companies also prefer to use a spreadsheet template that would allow them to add more information and figures into the sheet. The first row would indicate the total number of shares of the company, and the next rows would list the following:

- Authorized shares: The total shares the company is allowed to issue

- Outstanding shares: The total shares held by shareholders in the company

- Unissued shares: The total unissued shares

- Shares reserved for the stock option plans: The total unissued shares and reserved for future hires

There would also be another table that would have the following information:

- The names of shareholders who bought shares in the company

- The total number of shares owned by each shareholder

- Stock options owned by shareholders

- The total number of outstanding shares

- The total number of remaining shares available to be optioned

Other than this, the company’s founders, executives, and employees are also listed in the first table who own the equity along with the investors.

#2 Using cap table management software

Cap tables become complicated really fast. And because of this fact, its not always a good idea to store this information for long in an Excel sheet. The best way to stay organized is by using cap table software from the beginning of the company. Eqvista also allows you to use its application for free until your company has 20 shareholders. Once it increases, you will have to sign up for a subscription.

The moment you begin to hire employees and raise money, it’s hard to keep all the details on Excel. Only cap table management software will be the best choice. With a cap table software application, you will not have to send the updated Cap Table separately to every shareholder. Once you update the cap table on the application, it would be updated in real-time, and the shareholders would be able to see it.

Moreover, a cap table software application would help you with things like getting your 409A valuation, checking liquidity outcomes, issuing options electronically, right from one place. With Eqvista, you will get all the tools needed to take care of everything.

What are the advantages of using cap table management software?

There are many benefits to using a cap table software application, but some of the main ones include:

- Keep your cap table always updated: There are many transactions that take place in a company, such as the issuance of stocks and a funding round. These events affect the cap table a lot and need to be shared with the shareholders. With a cap table management software application, you would not have to share the updates with the shareholders separately. You can simply give them access to the cap table using the software, and they would see the updates in real-time.

- It will grow with your company: Unlike an excel sheet that would not be able to hold all the data as your company grows, cap table management software would be able to hold all the data and grow with your business. In addition to this, it would also help when new events or changes occur, such as getting a new 409A valuation, offering liquidity or issuing options.

- Save money in the long run: Although you might have to spend some money on a 409A valuation and the subscription for the software, it is all worth it. This is because you would avoid mistakes, which would help you save money.

- Avoid common errors: When you are managing a cap table using excel, there might be chances to make mistakes. Transactions take place very often in many companies. And if they are not recorded at the right time, it can cause errors. With an application, you can instantly fill in the details when the transaction occurs.

Create a cap table for Hong Kong company using Eqvista

With this said, one of the best cap table management software applications in the market is Eqvista. It is an advanced application that helps you track and manage all the shares in your company. You can save a lot of money that you would otherwise give your accountant or lawyer to create and handle your cap table.

Here are the things that make Eqvista worth it:

- Helps in managing all the equity accounting in one place

- Issue electronic stocks

- Maintain your equity ledger

- Create, manage and convert stocks to options and warrants

- Make better financial decisions by using the round modeling and waterfall analysis tool

- Manage the cap table and update it directly in real-time

- Share partial or full access of the cap table to the relevant parties

- Issue convertible instruments, including SAFE and KISS

- Create, manage and apply vesting schedules to the issuances

- Create ESOPs that support RSAs and RSUs

- Enjoy personalized shareholder accounts

- Get help with how to be a great founder and how to use the application through the knowledge center

- Handle all the board approvals right from the platform

- Stay compliant with all the various regulations

Eqvista is constantly developing, and the team keeps adding new features to make things easier and seamless for its users. To help you begin using the app, here is how to create a company on Eqvista and add a shareholder.

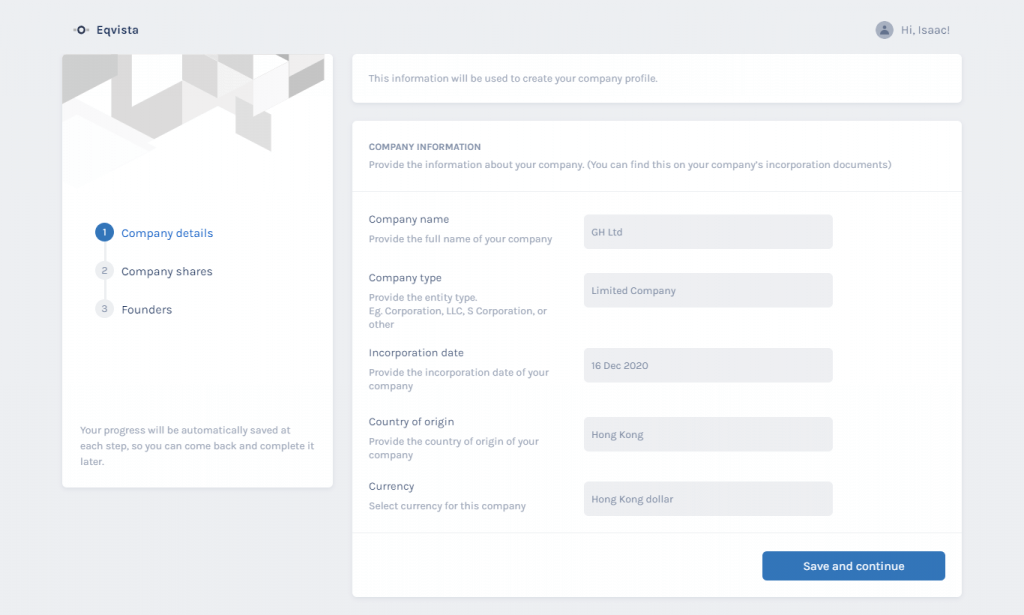

Onboarding for a Hong Kong Company

Before you can start, you will need to create your profile on Eqvista. Once you do this, you can then follow the steps below to create a company.

Step 1: As soon as you log into your Eqvista account, you will see the option where you can add a new company.

Here, add the company details as shared above and click on “Save and continue”.

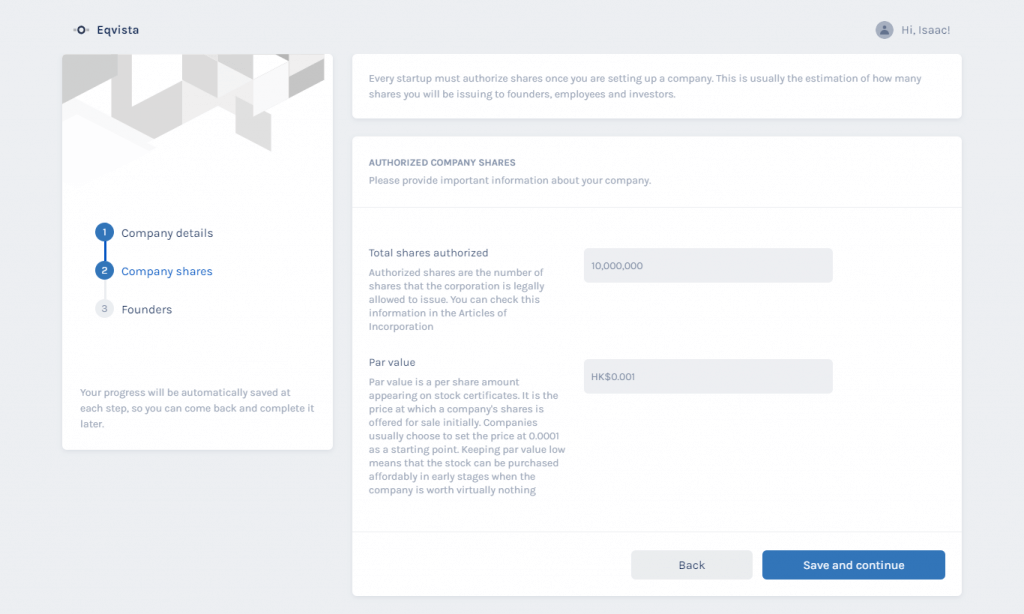

Step 2: You will reach the next step where you need to add the information about the company shares, and then click on “Save and continue”.

Step 3: This is the final step, where you will need to onboard the company’s founders. For this, select if you are the founder or not. If you are not the founder, click on “Add founder” and add the details of the founder there. If you are, then add your details. You can add more than one founder by clicking on “Add founder” for the number of founders in the company. Once done, click on “Save and continue”.

With this, you will reach the dashboard of the company.

Adding a new Shareholder & Issue Shares to Them

From here, let us see how to add a new shareholder in the company.

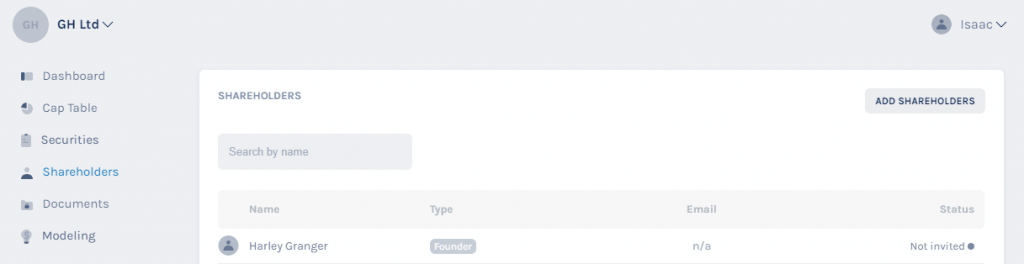

Step 1: From the dashboard, click on “Shareholders” and you will reach the following page:

Then click on “Add Shareholder”.

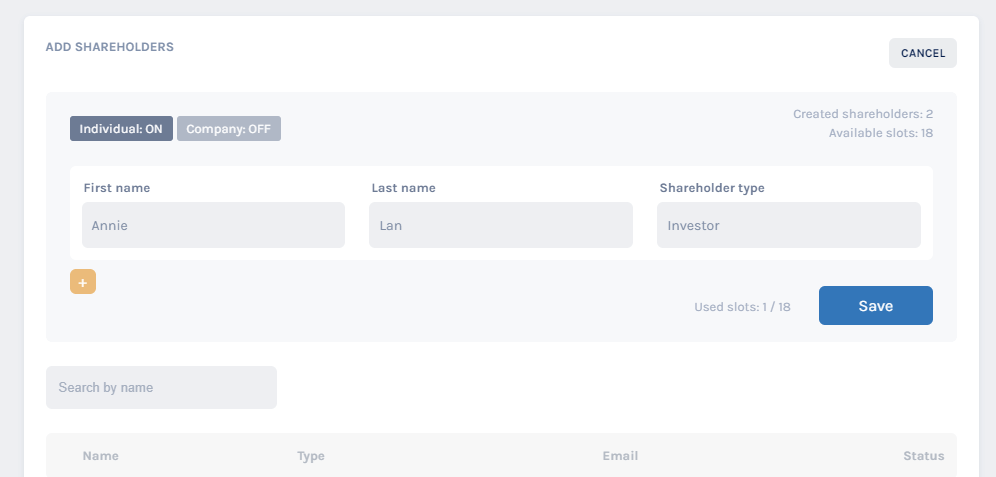

Step 2: A panel will appear where you need to add the details of the shareholder. Add in the details and click on “Save”. This would have added a new shareholder in the cap table Software application.

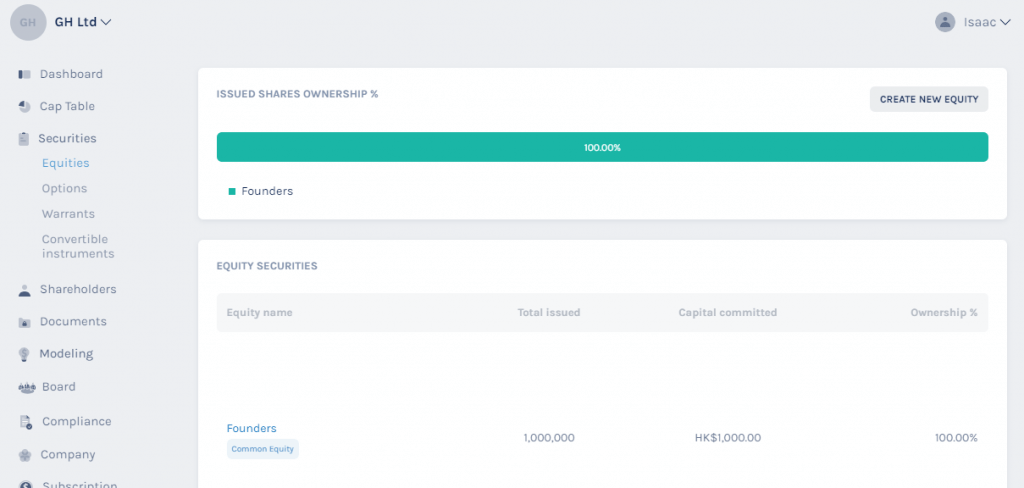

Step 3: From here now, click on “Securities” and then on “Equities”. This is to first create the share class from where you will then issue the shares to the shareholder.

Next click on “Create New Equity”.

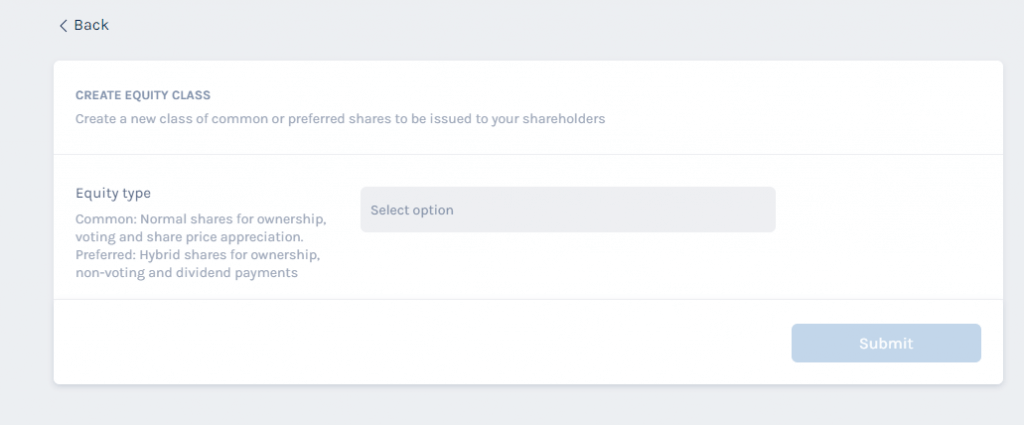

Step 4: By doing this, you will be directed to the following page:

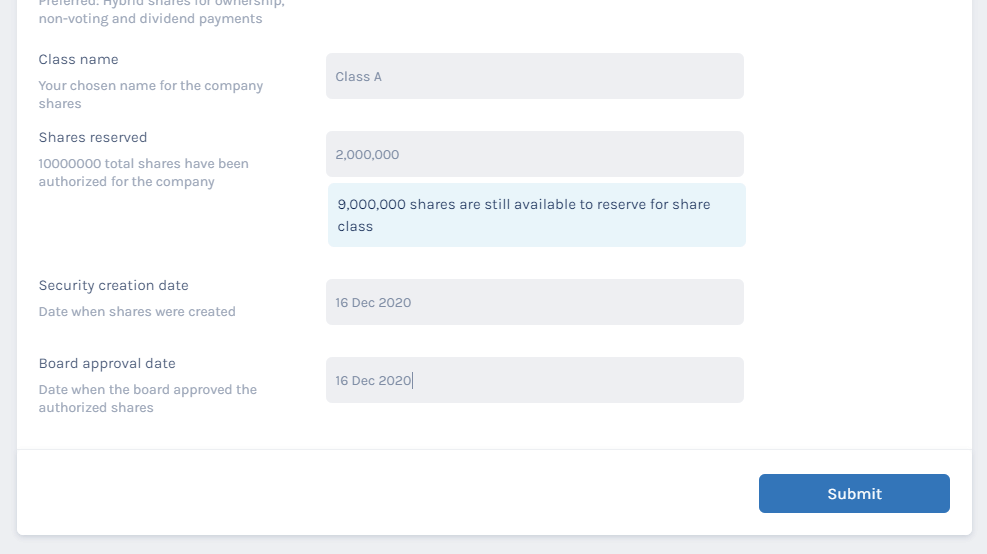

Select the kind of shares you want the class to have. Once done, a panel will appear:

Fill in the details and click on “Submit”.

Step 5: You will then reach the following page where you can see the details of the equity class. Here, click on “Issue Shares”.

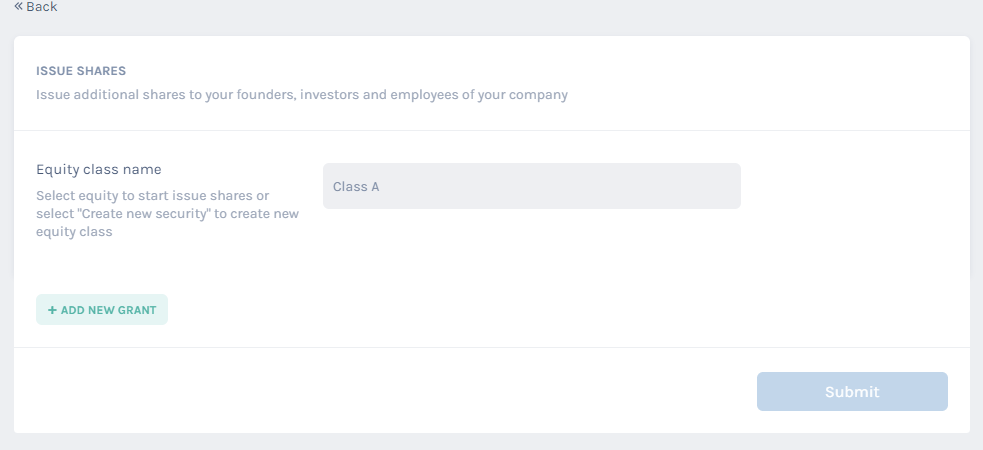

Step 6: By doing this, you will reach the following page.

Here, select the class name and then click on “Add new grant”.

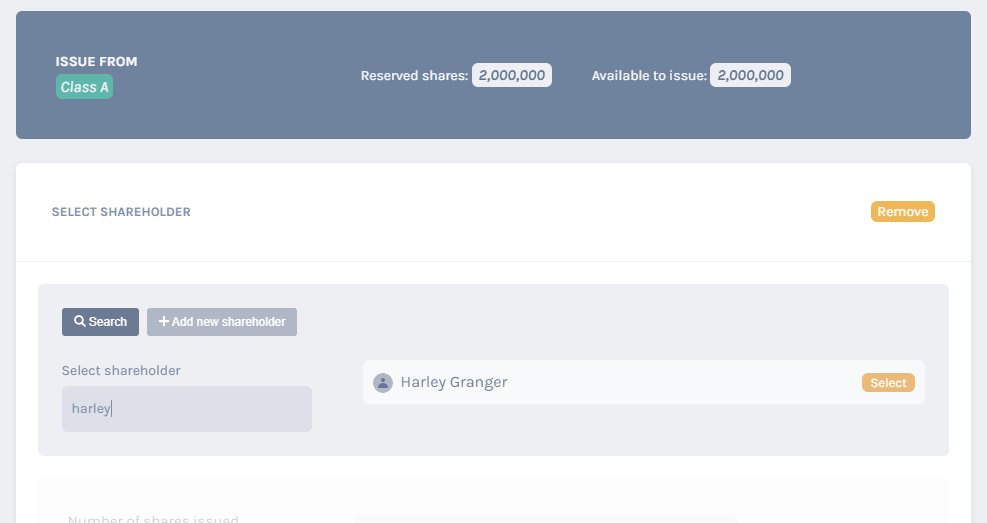

Step 7: A new panel would show up as shown below:

Type in the name of the shareholder that you want to issue the shares to in the search box as shown above, and then when the name appears, click on “select” beside the name.

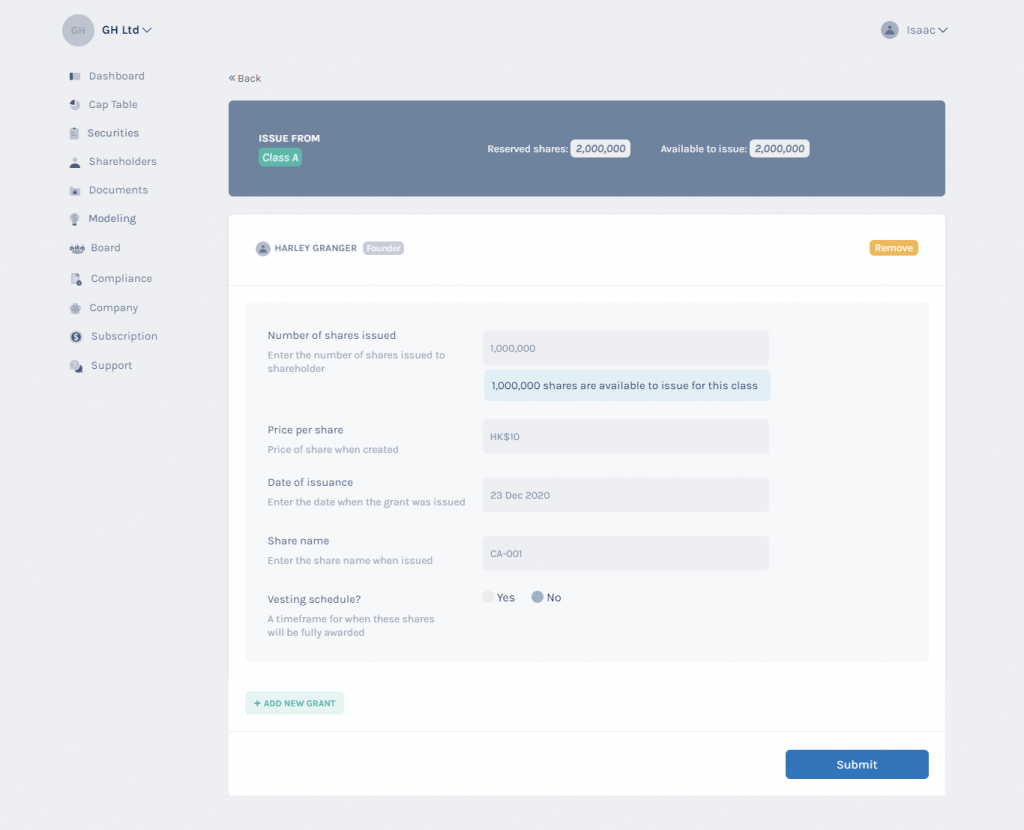

Step 8: Once you select the name, another panel would appear where you will begin the process of issuing shares to this shareholder.

Add in the details as shown above and then click on “Submit”. With this, the shares would be issued to the shareholder.

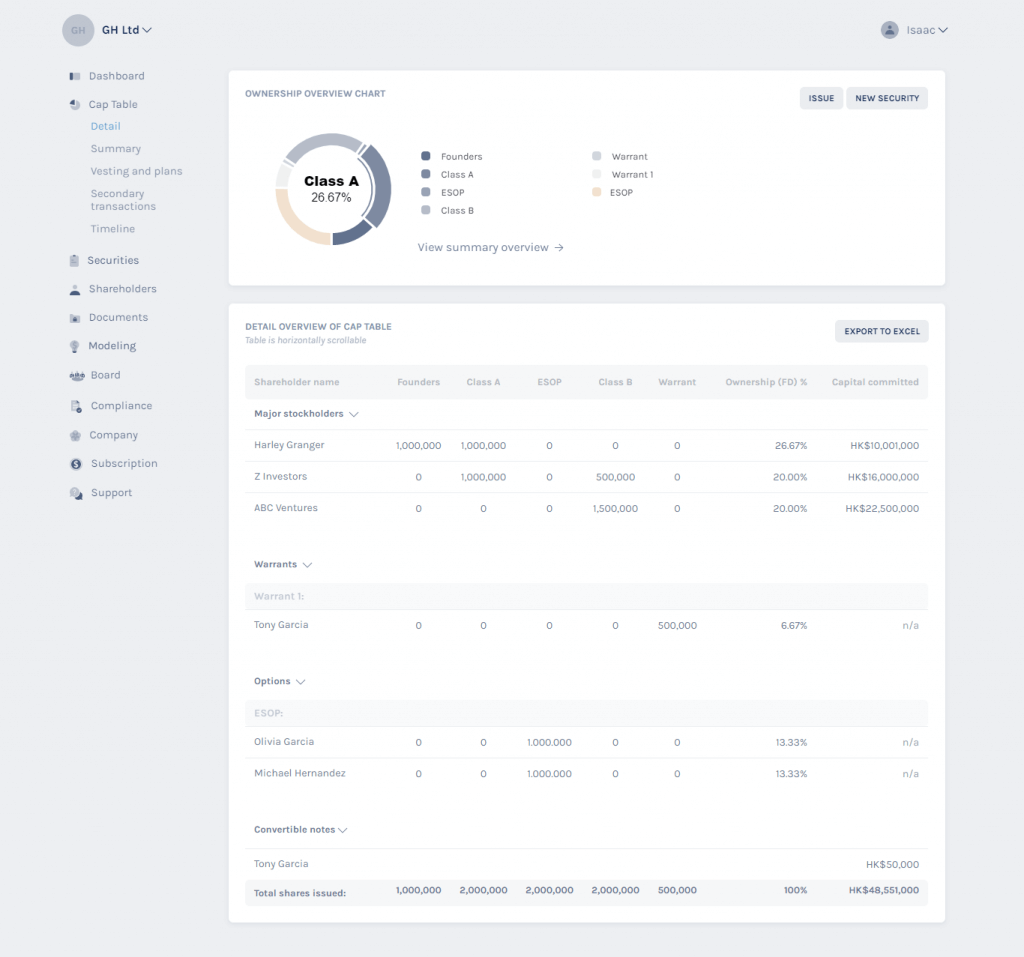

Viewing the Cap Table

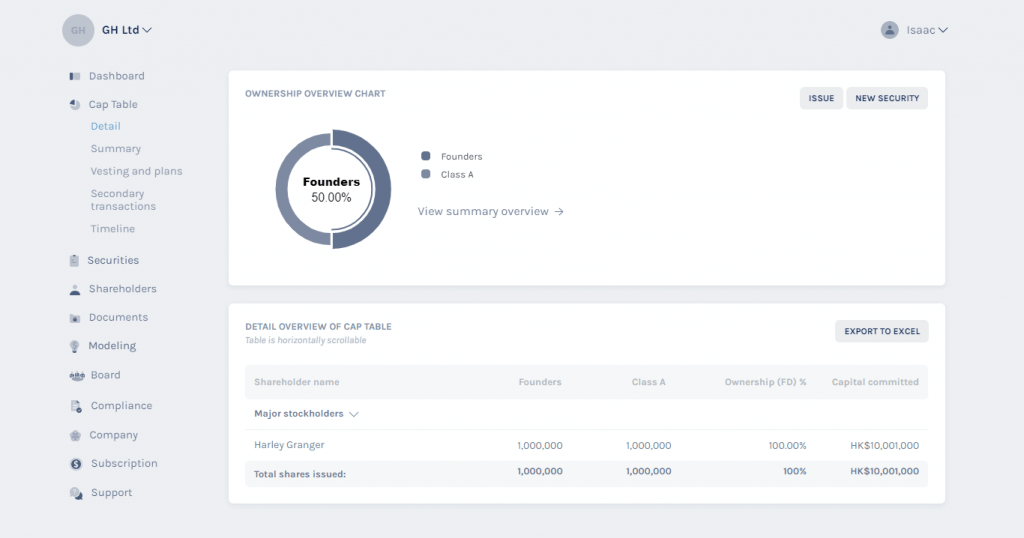

To see the cap table of the company, click on “Cap table” and then “Detail” on the left side menu. You will reach the following page that will show you the cap table of the company.

And just like this, you can add shareholders and see the cap table of your Hong Kong company using Eqvista, which is a simple to use cap table management software. To know more about how to use the app, visit here!