Dividend Income in Hong Kong

This article will provide you with an in depth overview of dividend income in Hong Kong.

Hong Kong has been known to have a tax friendly environment for both local companies and international corporations doing business in the city. This tax friendly approach is also applied to investments and how dividend income in Hong Kong is treated.

Generally speaking dividend income gained through investment holdings in Hong Kong is not subject to tax. For those investments overseas, this may fall under offshore income which can also be exempt from tax in the city, depending on various criteria. However this dividend income should be from the company’s investments and not it’s main source of income.

Dividend Income in Hong Kong

Dividend income is the distributed income derived from the company’s earnings to the shareholder’s class following its board of directors’ decisions. The shareholders are typically eligible for the dividend they have the stocks’ ownership before the ex-dividend date. It can be paid out in the form of additional stocks and cash payments. Let’s gather more information above dividend income in Hong Kong.

What is Dividend income in Hong Kong?

Since dividend income is not subject to Hong Kong taxes, the company’s shareholders no longer have to worry about it. This type of income is given by the companies as a form of reward to investors for putting their money into a new venture.

However, the dividend is approved by the shareholders through their voting rights. Though cash dividends are high in demand, dividend issues as shares of stock or other property are also used by public-listed companies. Moreover, there are various mutual funds and exchange-traded funds (ETF) that pay through dividends.

To be more precise, a dividend is a token reward paid to the shareholders for their investment in the company’s equity. It generally arises from net profit earned by the companies. However, some profits are kept aside as retained earnings so that it can be for ongoing and future business activities.

Let’s suppose if a company is not earning a sufficient amount of money to pay a dividend to its shareholders and keep aside the retained earnings. In that situation, some companies still decide to make dividend payments. This can be done to maintain a track record of making regular dividend payments to the shareholders.

The board of directors reserves the right to choose the time frame for issuing dividends with different payout rates. It can be paid at any schedule timeframe, monthly, annually, and quarterly.

Understanding the Different Types of Dividend Income in Hong Kong for Tax Purposes

Every company has embarked into the market with a purpose to earn a small part of additional money known as profit or revenue. It depends upon the company whether they want to reinvest that money into the business or distribute their capital to the investors in the form of a dividend.

Primarily, there are two reasons for offering dividends to investors:

- To increase the faith of investors in the company’s objectives.

- To show an optimistic viewpoint to investors that the company is serious about future earnings.

There are certain ways to pay a dividend to investors. The frequency of dividend payment can be monthly, annually, or quarterly. It solely depends on the company’s policy you are running. Let’s get to know more about the types of dividends.

Cash Dividend

The first type of dividend that you should be aware of is the cash dividend. Typically, this is the most popular form of dividend payment in the companies. The company issues the dividend to all the shareholders in their bank accounts where the money is deposited according to investor’s holdings. Generally, the dividend declaration is predefined or publicly announced.

Stock Dividend

Another type of dividend that companies usually issue as additional shares to their shareholders is a stock dividend. The company issues this type of dividend to its primary or main shareholders. This other form of dividend can be attractive to shareholders who wish to increase their holdings in the company.

Assets

Some companies reward their shareholders in the form of investment securities, physical assets, and real estate. However, this type of offering as dividends is still very rare among companies.

Dividend Income vs. Business income

Dividend income and business income are different terms that need to be understood to operate the business successfully. If you are also dealing with these two terms, we have given a brief detail about these two primary terms in the business field.

What’s the difference between dividend income and business income?

Business income is a type of earned income. The business derives it by offering services and products to its customers in its targeted region. It is also known as ordinary income for tax purposes. In Hong Kong, the income earned within the territory of HK is subject to tax; outsourced income is not liable to pay taxes.

On the other hand, dividend income is a kind of reward given by a company to its shareholders. These rewards can be offered in the form of cash, shares, cash, or cash equivalent. This type of income is distributed to the shareholder once the profit earned is reinvested in the company to scale up in the intense competition.

How does Dividend income in Hong Kong work?

Dividend income in Hong Kong, similar to interest income, is not as regulated as compared with other countries and jurisdictions as most dividend income is not taxed. As dividends are rewards for one’s investment holdings, as Hong Kong doesn’t have capital gains tax, then in general this type of income is not taxed. Due to this reason, Hong Kong remains an attractive financial hub for investments in Asia due to its tax friendly regulations for both companies and individuals.

How do I declare Dividend income for my Hong Kong company?

Dividend income for Hong Kong companies works similar to other sources of income, as it should be recorded in the accounts of the company and declared in the Profits Tax Return (PTR).

If the dividend income is not the main source of income for the company (ie. not an investment holdings company), then this amount can be tax deductible.

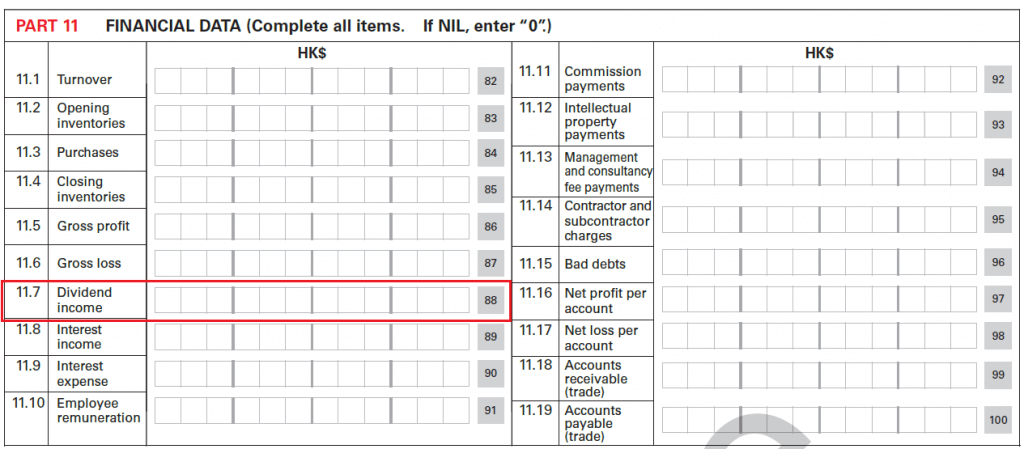

When filing the company’s Hong Kong tax return, the total amount of dividend income would be declared in box 11.7 in the Financial Data section.

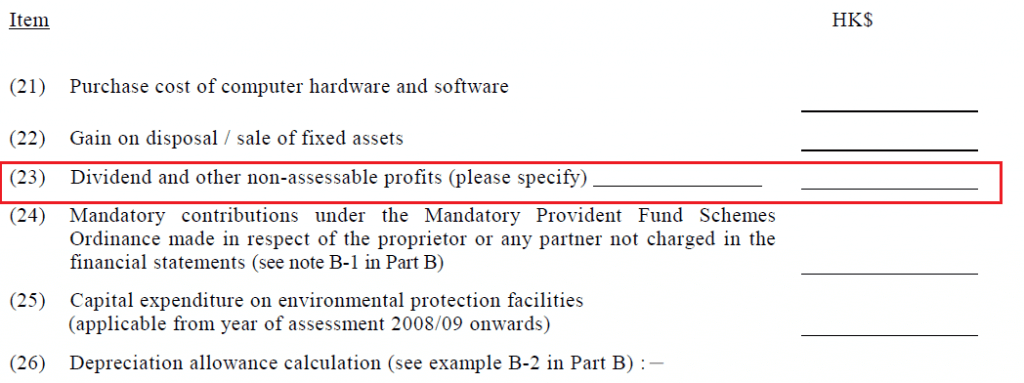

Accompanying the company’s PTR would be a tax computation, which is a summary of the company’s Income Statement and any adjustments for tax deductible/non-deductible figures. Here the company would also declare its dividend income in Hong Kong that it wishes to deduct.

Here is an example of the tax computation provided by the IRD. It’s important to note though that the tax computation submitted together with the PTR should be prepared by a professional Hong Kong CPA, to make sure it complies with all the tax regulations in Hong Kong.

It’s also recommended to have a full understanding of the audit requirements in Hong Kong, and what documents are required for the whole audit process.

How do I declare Dividend income for Hong Kong individuals?

Dividend income for individuals in Hong Kong in most cases is not taxable. Therefore any dividend income earned from investments in public companies through the HKEX, or even dividend income earned by private companies is not taxed, and need not be declared by the individual on their tax return.

Of course for some individuals holding both a shareholder and director/officer position in a company, it’s important to correctly classify the type of their income they receive.

Taxable Dividend income under tax treaties or double taxation agreement (DTA)

Under the Double Taxation Agreement (DTA), Hong Kong follows a territorial basis of taxation, which means the first jurisdiction where income is raised due to the business operations is liable to taxes. Hong Kong is in double taxation agreements with various jurisdictions globally. This double taxation agreement is also referred to as the tax treaties. It helps to prevent fiscal evasion and double taxation issues. And it also paves a path for fostering cooperation between Hong Kong and other international tax administrations.

Tax treaty rates with foreign countries

The below table will give you a brief detail about the tax treaty rates between Hong Kong and other jurisdictions in a Comprehensive Double Taxation Agreement where Hong Kong can charge taxes from HK residents for dividend income.

| Country / Region | Effective from | Dividend - Qualifying Companies(%) | Dividend - Others(%) |

|---|---|---|---|

| Austria | Year of Assessment 2012/2013 | 0 | 10 |

| Belarus | Year of Assessment 2018/2019 | 5 | 5 |

| Belgium | Year of Assessment 2004/2005 | 0/5 | 15 |

| Brunei | Year of Assessment 2011/2012 | - | - |

| Cambodia | Year of Assessment 2020/2021 | 10 | 10 |

| Canada | Year of Assessment 2014/2015 | 5 | 15 |

| Czech | Year of Assessment 2013/2014 | 5 | 5 |

| Estonia | Year of Assessment 2020/2021 | 0 | 10 |

| Finland | Year of Assessment 2019/2020 | 5 | 10 |

| France | Year of Assessment 2012/2013 | 10 | 10 |

| Georgia | Pending | 5 | 5 |

| Guernsey | Year of Assessment 2014/2015 | - | - |

| Hungary | Year of Assessment 2012/2013 | 5 | 10 |

| India | Year of Assessment 2019/2020 | 5 | 5 |

| Indonesia | Year of Assessment 2013/2014 | 5 | 10 |

| Ireland | Year of Assessment 2012/2013 | - | - |

| Italy | Year of Assessment 2016/2017 | 10 | 10 |

| Japan | Year of Assessment 2012/2013 | 5 | 10 |

| Jersey | Year of Assessment 2014/2015 | - | - |

| Korea | Year of Assessment 2017/2018 | 10 | 15 |

| Kuwait | Year of Assessment 2014/2015 | 5 | 5 |

| Latvia | Year of Assessment 2018/2019 | 0 | 10 |

| Liechtenstein | Year of Assessment 2012/2013 | - | - |

| Luxembourg | Year of Assessment 2008/2009 | 0 | 10 |

| Macao SAR | Year of Assessment 2021/2022 | 5 | 5 |

| Mainland of China | Year of Assessment 2007/2008 | 5 | 10 |

| Malaysia | Year of Assessment 2013/2014 | 5 | 10 |

| Malta | Year of Assessment 2013/2014 | - | - |

| Mexico | Year of Assessment 2014/2015 | - | - |

| Netherlands | Year of Assessment 2012/2013 | 0 | 10 |

| New Zealand | Year of Assessment 2012/2013 | 0/5 | 15 |

| Pakistan | Year of Assessment 2018/2019 | 10 | 10 |

| Portugal | Year of Assessment 2013/2014 | 5 | 10 |

| Qatar | Year of Assessment 2014/2015 | - | - |

| Romania | Income derived on or after 01.01.2017 | 3 | 5 |

| Russia | Year of Assessment 2017/2018 | 0/5 | 10 |

| Saudi Arabia | Year of Assessment 2019/2020 | 5 | 5 |

| Serbia | Pending | 5 | 10 |

| South Africa | Year of Assessment 2016/2017 | 5 | 10 |

| Spain | Year of Assessment 2013/2014 | 0 | 10 |

| Switzerland | Year of Assessment 2013/2014 | 0 | 10 |

| Thailand | Year of Assessment 2006/2007 | 10 | 10 |

| United Arab Emirates | Year of Assessment 2016/2017 | 5 | 5 |

| United Kingdom | Year of Assessment 2011/2012 | 0/15 | 0/15 |

| Vietnam | Year of Assessment 2010/2011 | 10 | 10 |

Need help with dividend income in Hong Kong?

This article is all about the dividend income in Hong Kong that you should be aware of. If you are thinking of establishing a business in Hong Kong, you should start gathering all the important information about various types of taxes in Hong Kong, whether it is interest income, dividends or capital gains tax.

If you need any kind of professional help to set up a business in Hong Kong, contact Startupr. Our experts will navigate you through the right path and give you a detailed guide and information so that you can scale up your business. We are renowned as one of the leading business incorporation and accounting service providers in Hong Kong. Feel free to contact us!

FAQ

Below, we’ve compiled answers to some of the most common inquiries regarding dividend income in Hong Kong. Understanding these aspects can help businesses and individuals navigate the city’s favorable tax environment more effectively. If you have further questions or require personalized advice, our team at Startupr is always ready to assist.

Is dividend income taxed in Hong Kong?

Generally, dividend income received by both individuals and corporations in Hong Kong is not subject to tax.

Is offshore dividend income taxable in Hong Kong?

Offshore dividend income may also be exempt from tax in Hong Kong, depending on specific criteria and if it’s not the company’s primary source of income.

What is dividend income?

Dividend income is a portion of a company’s profits distributed to its shareholders as a reward for their investment.

How are dividends approved?

Dividends are typically approved by the company’s shareholders through their voting rights.

What are the common forms of dividend payment?

The most common forms are cash dividends (direct deposit to bank accounts) and stock dividends (issuance of additional shares). Less commonly, dividends may be paid in the form of assets.

What is the difference between dividend income and business income?

Business income is earned through the sale of goods or services and is generally taxable in Hong Kong if sourced within the territory. Dividend income is a return on investment and is generally tax-free in Hong Kong.

How does a Hong Kong company declare dividend income?

While generally tax-free, dividend income should be recorded in the company’s accounts and declared in Box 11.7 of the Profits Tax Return (PTR). If it’s not the main income source, it can be tax deductible.

Are there any exceptions to the tax-free status of dividends in Hong Kong?

Under Double Taxation Agreements (DTAs) or tax treaties with certain foreign countries, Hong Kong residents may be subject to tax on dividend income received from those specific jurisdictions. The tax rates vary depending on the treaty.

What is the General Employment Policy (GEP) working visa mentioned in the context of setting up a business?

The GEP visa is for skilled individuals and entrepreneurs who wish to work and potentially establish a business in Hong Kong.

Who can help with understanding dividend income and tax obligations in Hong Kong?

Professional business incorporation and accounting service providers like Startupr can provide expert guidance on navigating Hong Kong’s tax regulations and ensuring compliance.

Last update: March 2025