Interest Income in Hong Kong

This article will let you know about the interest income taxable in Hong Kong and outline the important facts about interest income taxes.

Planning for taxes is always an important pillar for a Hong Kong company. When a company is driving profit in Hong Kong, it becomes mandatory for the company to pay taxes, whether it is on salary tax, profits tax, or interest income tax. Miscalculating such types of taxes could result in negative consequences for the business. This is why so much emphasis has been put on interest income taxes in Hong Kong.

This article will let you know about the interest income taxable in Hong Kong and outline the important facts about interest income taxes.

Interest Income in Hong Kong

Interest income is the amount charged to a business entity to lend money or let another entity use its funds. In broader terms, it is the amount earned by investors for funding a project. In Hong Kong, interest income is not subject to Hong Kong profits tax when the income is earned within the territory, depending on the company’s nature of business. Let’s get more information about interest income in Hong Kong.

What is Interest income in Hong Kong?

Hong Kong levies interest income tax on the profit earned by companies within the city. However, there are certain rules applicable to different types of taxpayers with respect to determining the source of interest income in Hong Kong, notably financial institutions. Usually, the interest income earned from normal businesses is exempted from taxes in Hong Kong.

Types of interest income

Interest income is earned when an individual or business entity receives interest payments either from savings accounts, corporate boards, and municipal boards, to mention a few. It is also considered as revenue from interest earned on assets. In fact, the interest can be paid annually, quarterly, or monthly.

However, it is always advisable for business founders and individuals to keep a track record of the received interest income. This will make the process for paying the income interest tax much easier. To make it even more simpler, you can also send out monthly or annual reports on the amount of interest income you have received. Below are the different types of interest income in Hong Kong that you should be aware of:

Bank Account Interest

The first interest income that individuals should be aware of is savings account interest that everyone usually earns. This is the amount given by banks to its customers for keeping money in their savings bank account. There are many people who are operating under more than one savings account. In order to keep a track record of all accounts and account holders, it is recommended that everyone should keep a report of interest income from all accounts under your name.

Loan Interest

The second type of interest income is loan interest. Loan interest rates are the amount claimed by lenders to a borrower for the usage of assets, with higher risk loans having a higher interest for the borrower, and vice versa.

Bond interest (Coupon Payments)

Another type of interest income is generated from an instrument commonly called a corporate bond. It is a debt security issued from corporations to investors. Generally, these bonds are riskier than government bonds because of their high-interest rates. When a party receives interest from these bonds, they need to report it to the HK government if applicable.

Interest income vs. Business income

Got confused by business income and interest income? Both terms are assessed in Hong Kong differently depending upon the company’s activities.

What’s the difference between interest income and business income?

Business income is a term that is normally used in tax reporting for Hong Kong companies. When a business receives income from its products and services, it is considered as business income. For instance, the rents received by a person in his real estate business is considered business income.

On the other hand, the earnings generated by investments such as a certificate of deposits and savings accounts are referred to as interest income. In short, it is the amount earned by individuals by lending money to other entities or investing in other firms in the form of revenue.

In Hong Kong, if the investment is claiming interest as a part of business transactions, it would be assessable as a business income. However, if the interest income earnings are not directly derived from the business, it would be assessable as interest income from other sources.

Let’s take an example, Nick Ross is operating a car mechanic business. The revenue he is generating from the business is known as business income. It is liable to taxes as per the jurisdiction of the country he is operating the business in. And when he puts that money in a bank account to earn interest from his bank, this income will be converted into interest income for the business because this is not the main source of income for the business.

Another example is when a company uses investment as an income source. An investment company is a financial institution that uses pooled resources and capital of investors in financial securities. The pooled money is invested in these types of companies and the investors would need to share the profits and losses of the company as per each investor’s interest in the company. As these investments are a main source of income for the company, the interest gained on these investments would be fully taxable in Hong Kong.

Business income is typically earned through organized, profit-driven activity. Otherwise, it’s considered interest income.

How does interest income in Hong Kong work?

Interest income in Hong Kong is not as regulated as compared with other countries and jurisdictions, as most of interest income is not taxed, as with no capital gains tax in Hong Kong. Therefore most interest income gained through investments holdings is not taxed by the government, however this amount needs to be declared on the tax return of a Hong Kong company.

How do I declare interest income for my Hong Kong company?

Interest income for Hong Kong companies work similar to other types of income, in that it should be recorded in the company’s accounts and declared during the company audit and tax return filing.

If the interest income is earned not in the ordinary course of business, (ie. not from the main source of income for the company), then this amount can be tax deductible.

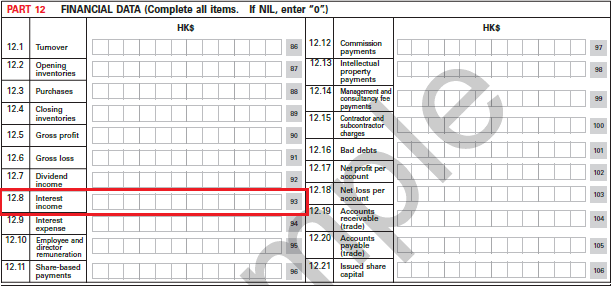

On the company’s Hong Kong tax return, the total amount of interest income would be declared in the Financial Data section.

Then, the company must also report the total amount of that income in “box 10.5” on their tax form.

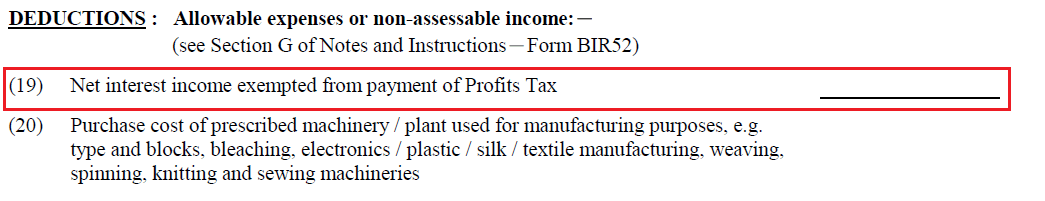

With any Profits Tax Return (PTR) filing for a Hong Kong company, a complete tax computation form should also be filed, with the deduction for interest income in Hong Kong as well.

You can find an example of this tax computation from the IRD’s website. Submit a CPA-checked tax computation with your PTR.

You should also take some time to understand the audit requirements in Hong Kong, and what company documents should be collected and the whole audit process for your tax filing.

How do I declare interest income for Hong Kong individuals?

Interest income for individuals in Hong Kong in general is not taxed (some exceptions occur for real estate holdings). Interest income from investments or bank deposits does not need to be declared on your personal tax form or included in your total annual income.

Taxable Interest income under tax treaties and double taxation agreements (DTA)

When two countries prepare a bilateral resolution to resolve the issues revolving around double taxation of passive and active income. It is known as a tax treaty or double taxation agreements.

Many countries have participated in tax treaties with other countries to mitigate double taxation issues. Hong Kong is one of them. Foreign profits are not taxed again in Hong Kong.

Double taxation is also commonly known as the source-residence conflict. Income earned in a jurisdiction is considered source income. And the other authority where the income is received is the province of residence.

Tax treaty rates with foreign countries

Do you want to know which countries follow a double taxation agreement with Hong Kong? And what are tax treaty rates with foreign countries?

The below table outlines the countries’ maximum rates and regions with a Comprehensive Double Taxation Agreement. This agreement illustrates the amount of interest income per country.

| Country / Region | Effective From | Interest (%) |

|---|---|---|

| Austria | Year of Assessment 2012/2013 | - |

| Belarus | Year of Assessment 2018/2019 | 5 |

| Belgium | Year of Assessment 2004/2005 | 10 |

| Brunei | Year of Assessment 2011/2012 | 5/10 |

| Cambodia | Year of Assessment 2020/2021 | 10 |

| Canada | Year of Assessment 2014/2015 | 10 |

| Czech | Year of Assessment 2013/2014 | - |

| Estonia | Year of Assessment 2020/2021 | 0/10 |

| Finland | Year of Assessment 2019/2020 | - |

| France | Year of Assessment 2012/2013 | 10 |

| Guernsey | Year of Assessment 2014/2015 | - |

| Hungary | Year of Assessment 2012/2013 | 5 |

| India | Year of Assessment 2019/2020 | 10 |

| Indonesia | Year of Assessment 2013/2014 | 10 |

| Ireland | Year of Assessment 2012/2013 | 10 |

| Italy | Year of Assessment 2016/2017 | 12.5 |

| Japan | Year of Assessment 2012/2013 | 10 |

| Jersey | Year of Assessment 2014/2015 | - |

| Korea | Year of Assessment 2017/2018 | 10 |

| Kuwait | Year of Assessment 2014/2015 | 5 |

| Latvia | Year of Assessment 2018/2019 | 0/10 |

| Liechtenstein | Year of Assessment 2012/2013 | - |

| Luxembourg | Year of Assessment 2008/2009 | - |

| Macao SAR | Year of Assessment 2021/2022 | 5 |

| Mainland of China | Year of Assessment 2007/2008 | 7 |

| Malaysia | Year of Assessment 2013/2014 | 10 |

| Malta | Year of Assessment 2013/2014 | - |

| Mexico | Year of Assessment 2014/2015 | 4.9/10 |

| Netherlands | Year of Assessment 2012/2013 | - |

| New Zealand | Year of Assessment 2012/2013 | 10 |

| Pakistan | Year of Assessment 2018/2019 | 10 |

| Portugal | Year of Assessment 2013/2014 | 10 |

| Qatar | Year of Assessment 2014/2015 | - |

| Romania | Income derived on or after 01.01.2017 | 3 |

| Russia | Year of Assessment 2017/2018 | - |

| Saudi Arabia | Year of Assessment 2019/2020 | - |

| Serbia | Pending | 10 |

| South Africa | Year of Assessment 2016/2017 | 10 |

| Spain | Year of Assessment 2013/2014 | 5 |

| Switzerland | Year of Assessment 2013/2014 | - |

| Thailand | Year of Assessment 2006/2007 | 10/15 |

| United Arab Emirates | Year of Assessment 2016/2017 | 5 |

| United Kingdom | Year of Assessment 2011/2012 | Domestic rate |

| Vietnam | Year of Assessment 2010/2011 | 10 |

Need help with interest income in Hong Kong?

Do you need any assistance with interest income in Hong Kong? Startupr is one of the leading business incorporation and accounting service providers in Hong Kong. We will help you operate your business in the business-friendly environment of Hong Kong without worrying about taxation. Startupr will let you know how Hong Kong’s jurisdiction imposes taxes on business owners, and how you should proceed with it.

We offer consultation and assistance for taxation matters and other information regarding corporate taxation, personal taxation, and company formation. Feel free to get in touch for further details.

FAQ

Do you have more question related to this topic? Check our section “frequently asked questions“, or do not hesitate to contact us.

Is interest income taxable in Hong Kong?

It depends. For individuals, generally no. For companies, it depends on the source and nature of the business.

What are the different types of interest income?

Common types include bank account interest, loan interest, and bond interest (coupon payments).

How is interest income different from business income?

Business income comes from a company’s core operations (products/services), while interest income is earned from investments or lending.

How do I declare interest income for my Hong Kong company?

It must be recorded in the company’s accounts and declared during the company audit and tax return filing.

What is box 10.5 on the Hong Kong tax return?

It’s where companies declare exempt interest income that isn’t their main source of revenue.

What is a PTR?

PTR stands for Profits Tax Return.

Where can I find the tax treaty rates with foreign countries?

The article provides a table listing the countries and their maximum interest income tax rates.

Last update: February 2025