Hong Kong Company Incorporation Process

Complete Guide on How to Set Up Your Business Internationally.

For Hong Kong Company Incorporation, it’s smart to understand the local norms and regulations beforehand. Hong Kong simplifies the process for new entrepreneurs, welcoming all types of ventures—whether it’s a service-based business, a high-tech firm, or a company trading physical goods.

For new business owners, at first, it can be a bit daunting to incorporate a company in Hong Kong. That’s why we suggest you find a good local agency that is experienced with guiding new business owners in setting up and running a company in Hong Kong. You can go through their package rates and the services that they provide, and hire them for whichever ones you need. Some even offer tailored packages for people looking for something extra, such as help with opening a bank account, accounting and taxation services, and the set up of a business address.

Which Documents Do You Need To Register a Company in Hong Kong?

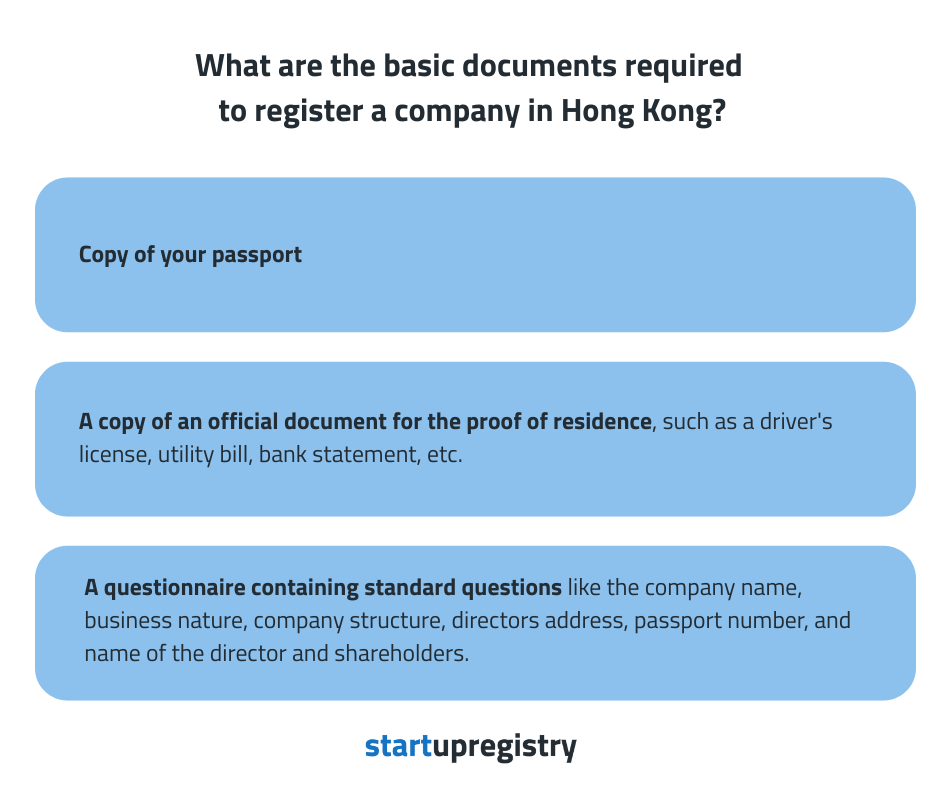

Like anywhere else in the world, there are some documents that are required to register a company in Hong Kong. These documents will help the government offices in keeping your personal records and details, and they also act as proof of your being the owner of the company.

Other things to consider are choosing a name for your new company and applying for the “profits tax exemption” if your business activities are conducted outside of Hong Kong, so as to make sure that your company is subject to 0% corporate tax rate.

List of the basic documents that you would need to register your company in Hong Kong:

- A copy of your passport

- A copy of an official document for proof of residence, such as a driver’s license, utility bill, bank statement, etc.

- A questionnaire containing standard questions like the company name, business nature, company structure (directors and shareholders), directors’ address, passport number, and name of the director and shareholders

Starting a Business in Hong Kong: A Global Gateway

There are no restrictions on nationalities for business owners in Hong Kong. This unique appeal attracts many to start businesses here, unlike in other Asian countries such as Singapore, Thailand, and Mainland China. You can be from any country to open a company in Hong Kong, along with proof of residence to verify your residential address in the government records.

Keep in mind that no matter what the agent does for you, only you will be the owner of the company. The agency that you hire will only provide you with its registered address and provide you with a secretary to represent your business if you don’t live in Hong Kong. You have the freedom to access your business from anywhere in the world. So it means that you can easily set up your business in Hong Kong and don’t have to be physically present there.

Procedure for Incorporating a Company

The process for setting up a company in Hong Kong is quite straightforward and easy for most. With the documents prepared to register a company and a suitable name, you’re on your way to starting a company. If you’re unsure about the name, you can easily do a quick name search to double-check that the name you want is still available. Once your name is chosen and the documents are all ready, you can send them to your agent for them to process.

Follow these steps to set up your company:

- You would need to contact the agency that you have decided is right for you (which you can determine after reading the tips here), and discuss the details.

- After that, choose the name of the company using the agency’s website.

- The next step is to send the necessary documents to them and pay them for the services. Most agents should offer payments through PayPal, bank transfer, or credit card. Choose the Hong Kong agency that has a customizable package for the services, so that you can choose as per your needs.

- You would need to send in your passport copy, an official document as proof of residence, like a driver’s license, and a questionnaire to let the agency know about the number of directors and the other essential parts of the business you want to open in Hong Kong.

- Let them process and fill out the form to obtain the required documents from the government.

- The process should take a few days to register your company. If you’re in a hurry, some agencies offer fast or expedited incorporation services (Possibly for those who are under a time constraint due to flight times or busy schedules)

- The company documents that you get are the certificate of incorporation, business registration certificate, Articles of Association, and incorporation form (NNC1), which means that you have opened a business in Hong Kong.

- You may now choose to schedule a meeting for a corporate bank account or conduct business under your company’s name!

In the following table, we have briefly summarized the process of setting up a company in Hong Kong for you:

| Phase | Step | Description |

|---|---|---|

| 1. Initial Engagement & Planning | 1. Choose Company Name | Select your desired company name, often by using the agency's website for availability checks. |

| 2. Submit Documents & Pay | Send all necessary documents to the agency and make payment for their services (usually via PayPal, bank transfer, or credit card). Opt for an agency offering customizable service packages that fit your needs. | |

| 2. Information & Processing | 3. Provide Required Information | Submit your passport copy, official proof of residence (like a driver’s license), and a questionnaire to inform the agency about the number of directors and other essential details for your Hong Kong business. |

| 4. Agency Processes & Filings | The agency will now process and fill out the forms required to obtain the necessary documents from the government on your behalf. | |

| 3. Incorporation & Readiness | 5. Company Registration | Your company should be registered within a few days. If you're in a hurry, some agencies offer expedited incorporation services, which can be useful if you're on a tight schedule. |

| 6. Receive Company Documents | Once registered, you'll receive the official company documents, including the Certificate of Incorporation, Business Registration Certificate, Articles of Association, and the Incorporation Form (NNC1). This signifies that your business is officially open in Hong Kong. | |

| 4. Post-Incorporation Actions | 7. Proceed with Business Operations | With your company legally established, you can now choose to schedule a meeting for a corporate bank account or immediately begin conducting business under your company’s name! |

Post-Registration: Your Hong Kong Business Takes Flight

Once your business gets registered in Hong Kong, you will be given your documents that allow you to easily conduct your business and open bank accounts outside Hong Kong. You don’t need any kind of capital investment for the company incorporation (though you may need a deposit to open a corporate bank account). All you need is at least one director, one shareholder, a company secretary and also a registered company address in Hong Kong (you can use your agency’s address as your business address if it allows).

In a nutshell, the procedure to incorporate a company is quite straightforward and is easy when you hire a local agency that can make it hassle-free for you. You only have to provide the local agency with your details, and they can use them for the rest of the procedure.

Hong Kong Company Formation Documents

Incorporating a company in Hong Kong is not an easy job, but once it has been done, you can enjoy the benefits of having your own company and working for yourself. However, doing all the tasks related to the company formation documents and other formalities can be time-consuming and long-winding. You need an accountant or an agent who will help you with all the tasks. It is also very important for any new entrepreneur to apply for the offshore status so that the company is at a 0% tax rate.

Once everything is smoothly completed, you’ll receive the company formation document, proving your company is established in Hong Kong. It is very important to have these documents, as they act as your identity for setting up business in Hong Kong and also as proof of your ownership. You should receive the following documents once your company is formed:

Documents issued by the Hong Kong government:

- Certificate of Incorporation: It is a document that states the date of incorporation for your company in Hong Kong.

- Business Registration Certificate: It’s a government certificate that states your company’s certificate number and when your business registration expires. Be sure to mark down this date, as if the company is not renewed in time, the Hong Kong government may issue a late penalty to the company.

- Articles of Association state the company’s owners and shares, and also outline all the laws and regulations for limited companies.

- Incorporation form (NNC1) details all the information about your Hong Kong company, including the name, address, company secretary, directors, shareholders, and number of shares. This is a sort of summary of all the important information for your company.

Documents that may be issued for the company:

- Register of members

- Share certificates

- Minutes of the first meeting

- Company Organization Chart

- Register of Director and Company Secretary

The company secretary may issue these additional documents for the company. These documents help with stating your claim as the company, and may help when provided to a bank for a bank account opening.

Navigating Agency Packages and Ongoing Costs

Different agencies have different packages that they offer to their customers. The packages generally include all the important procedures of establishing a company business in Hong Kong. From the company registration to bank account opening, the packages generally include all the features. You can go through the plans of the agency you are going to hire and select the best plan for you.

Let us say that you decide and choose a Hong Kong agency, and hire them to provide you with all the services from forming the company to acting as the company secretary and providing their registered address as your company’s official address. The total things that you would need to pay in a year are:

- Company formation & Incorporation documents

- Business Registration Certificate (Government fee)

- Company Registration (Government fee)

- Provision of the Registered Office Address

- Provision for the Company Secretary

- Business Bank Account Opening (If they offer this service)

How much does it cost to incorporate a company in Hong Kong?

As mentioned above, these services are the normal services that people normally pay for to an agency. All in all, the normal rates for setting up a business would be around $1,000 to 1,500.

You might come across a better one that would offer you a much lower price. But, be sure to check the agency, as not all of them are honest, as later on they might come up with stories and even charge you more than the amount that has to be paid. Did they provide you with a company secretary? Did they offer you the registered address? Will they assist you in opening a bank account? You can find out how to determine the honesty of an agency in our other guide.

This can vary based on your requirements, but the essentials would be the company formation, business registration and government fees, and a company secretary. Since the law requires a registered company secretary, we suggest using the agency that formed your company; they likely know your company best, ensuring a seamless process.

Subsequent Year Costs and Tax Obligations

If you don’t have an address is Hong Kong, then you would need to arrange a registered address for the company. If you live in Hong Kong, then you can use your business address, but if you are outside of Hong Kong, then we would suggest using the registered address of the agent. But you should know that this is merely a registered address for the government, mostly for any official forms the government sends you in the future, but it does not act as your business address for your daily business use or for invoicing purposes.

For the second year, you would need to pay:

- Renewal of the Business Registration Certificate (Government fee)

- Provision of the Registered Office Address

- Provision for the Company Secretary

- Annual Return (Government fee)

Ongoing Maintenance and Tax Considerations

In the second year, you would be spending relatively less in maintaining the company. Note that the business certificate renewal process is a straightforward one and there is no need to sign any documents. When you choose a Hong Kong agency, they will take care of all the paperwork and send the new certificate to you after you have submitted the fee.

After all this, 18 months later, you would have to fill the profits tax return, where some agencies also provide the accounting and auditing services to you. Check the agency to know about this, and since nothing comes for free, the prices may vary based on the number of transactions your company has. If you don’t reside in Hong Kong, also ask if they offer taxation services for offshore clients and have experience handling their needs.

New entrepreneurs can choose from the packages suitable for them and contact the agency regarding the same. Startupr will provide you with a hassle-free incorporation process for your company so that everything runs smoothly, and you don’t miss any important company filings. Just tell the company which package you want, and they’ll simplify your incorporation process.

Transparent Services & Dedicated Support with Startupregistry

At Startupregistry, our Hong Kong Company Incorporation services are designed with your benefit in mind, offering clear advantages and complete transparency for your business. We believe in straightforward dealings – you’ll always get exactly what you need, with no surprises. Our plans are annual, and to ensure uninterrupted service, simply renew your plan each year.

Please get in touch for renewal fees, and continue to operate your company in Hong Kong. If you go ahead with our accounting services, we only require that you email us your bank statements and invoices, and then we will take care of your profits tax return. We are conscious of the complexities of taxes, so please let us do the work for you. Our other guides will help you determine an agency’s reliability.

Last update: June 2025