As a company that has grown alongside the private equity (PE) market over the last 17 years, Startupr has closely observed the increasing liquidity constraints faced by investors in this asset class. Currently, 78% of PE firms are holding assets beyond their typical investment horizon. These challenges are not expected to ease any time soon. In fact, PE firms do not expect to make exits within 12 months for 67% of their assets.

To make matters more pressing, 65% PE firms also report challenges in capturing the value they’ve created in exit EBITDA figures. This creates disparities in perceived asset prices and further slows down deal velocity.

In this context, we introduce Eqvista’s Real-Time Company Valuation®, a highly relevant solution. It is designed to address the transparency issues plaguing the market through standardized, real-time assessments. Let’s take a closer look at what makes Real-Time Company Valuation® a game-changer for the private equity industry.

What is Eqvista’s Real-Time Company Valuation®?

While AI excels at pace and scale, human expertise remains critical for nuanced, context-driven insights. In Eqvista’s Real-Time Company Valuation®, you get the best of both worlds. It enables real-time access to audit-defensible valuations.

Additionally, we believe that you can leverage this software to strengthen financial reporting and improve stakeholder communications.

Empowering informed decision-making

Eqvista’s real-time valuation software can serve as private equity’s proxy for the stock market’s price-setting mechanism, empowering investors as well as companies to make more informed decisions in the following ways:

Timely insights

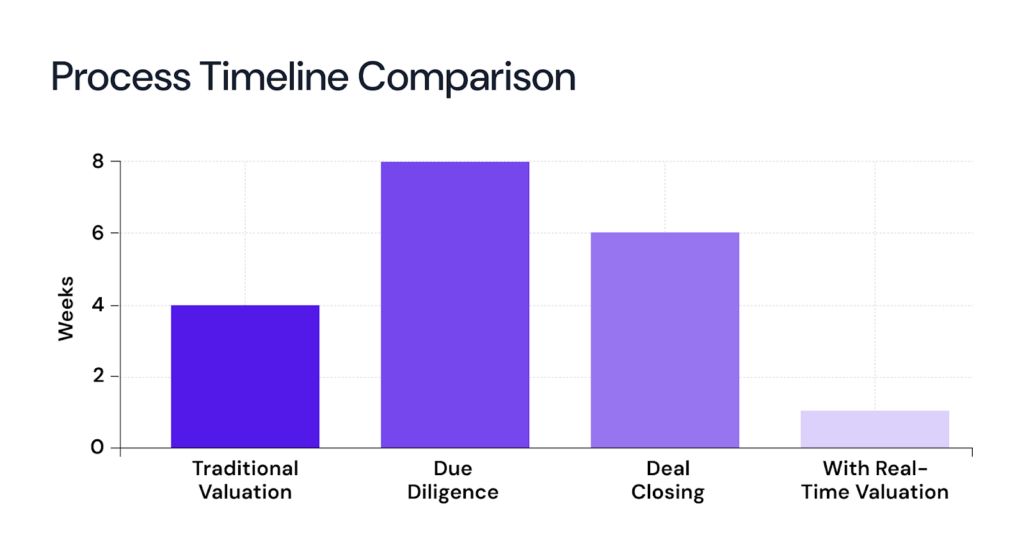

Investors can get an edge over their competitors in closing lucrative deals with real-time valuation insights. Instead of spending weeks on valuation exercises and leaving the door open for competitors to snoop in, investors can recognize advantageous price points in an instant and swiftly move to close deals.

Greater alignment with market conditions

Instead of basing decisions on outdated assessments, investors as well as company management can enhance their decision-making with market-aligned valuation insights.

Faster risk assessments

Unfortunately, in private markets, risk management is often limited to rebuilding a portfolio in the aftermath of a risk materializing. But, Eqvista’s software enables you to identify deteriorating or improving asset conditions in real-time. This lengthens the timeline investors have to devise and execute portfolio adjustments.

Better benchmarking

Real-time valuation insights enable company management to benchmark performance against the industry, which provides critical insights about best practices and drives continuous improvement.

Informed tactical decisions

A public company will often optimize short-term plans to maximize its share price, essentially using it as a North Star metric. However, this can lead to sub-optimal decision-making due to biases inherent in the stock market. Eqvista’s Real-Time Company Valuation® improves on the utility provided by share prices by avoiding behavioral biases.

Faster stress testing

General partners can leverage real-time valuations to spot adverse shocks early or to simulate the impact of various possible scenarios on their funds. This enhances decision-making significantly and positions general partners to execute better hedging strategies.

Bridging the transparency gap between public and private equity

There is a significant gap in the volume of disclosures made by public and private companies. This leads to inefficient decision-making and stagnant deal flow in the private equity market. When we talk about transparency in private equity, the characteristic that stands out the most optically is the lack of quoted asset prices. Even if a stock market investor is not aware of the recent developments about a certain company, they can still base entire strategies on the company’s share price. This is because all material information is often factored into share prices.

Until now, private equity lacked this attribute. As a result, private equity markets can be extremely sluggish. Investors often hesitate to venture into this asset class due to the challenges in pinpointing attractive entry prices and managing complex and opaque portfolios.

But, Eqvista’s real-time valuation software can change this dynamic entirely in the following ways:

- Standardized valuations: The real-time valuation software standardizes valuation methodologies and prevents price manipulations through subjective inputs. This not only enables better comparisons but also fosters trust between companies and investors.

- Enhanced reporting cadence: Private equity participants can leverage Eqvista’s software to mirror the valuation disclosure frequency in public markets. As discussed earlier, this would improve portfolio management by catalyzing risk assessments and enabling faster identification of exit opportunities.

- Clarity in investor communications: By incorporating detailed valuation history into performance reviews, a company eliminates the need for management to rely on complex statistical justifications for its decisions. Instead, investors can just review the market conditions, company actions, and the resulting valuation changes.

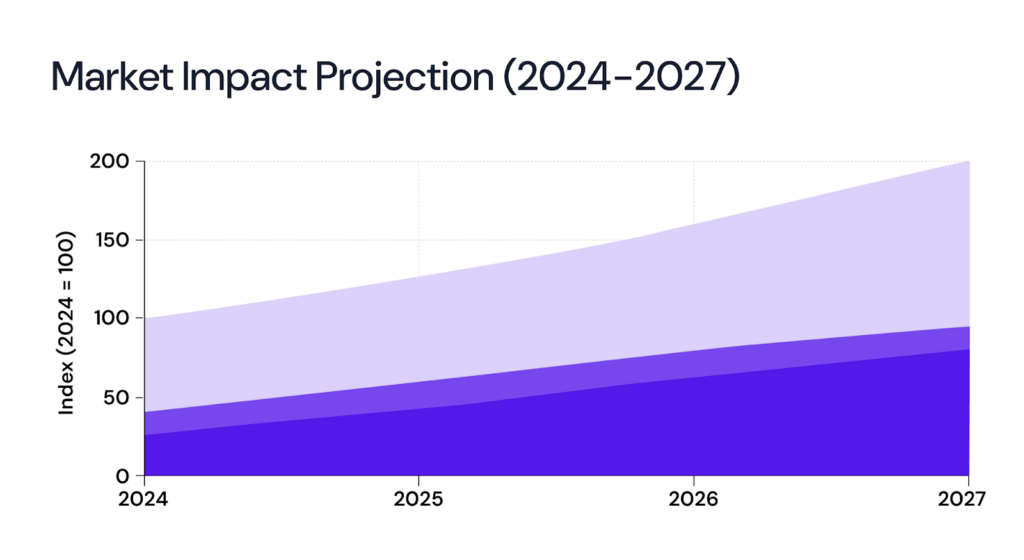

- Boosted institutional appeal: Enhanced valuation transparency significantly reduces the risks associated with private equity. Thus, real-time valuations would trigger an inflow of investors, which enhances access to capital and increases overall liquidity in the market.

- Easier alignment with regulatory requirements: Rather than spending weeks on company valuations for regulatory needs such as stock option expensing and 409A compliance, you can now complete these tasks in seconds. This frees up time to focus on more strategic and mission-critical priorities.

- Shift towards technology-led transparency: Wider adoption of Eqvista’s Real-Time Company Valuation® can trigger a shift toward more openness through digital infrastructure. Greater visibility into individual asset prices could be a stepping stone towards the establishment of private market indices, which would further enhance decision-making through better benchmarking. A long way down the road, this could also trigger improvements in private equity derivatives.

How would real-time insights transform the private equity market?

Real-time valuation insights can make private equity markets more accessible to investors, while also encouraging greater lending to private companies. Together, these factors are likely to accelerate deal velocity. Here’s how:

Enhanced investor confidence

Private equity investors need not rely on subjective and periodic valuations provided by general partners or the management of their portfolio companies. Instead, they will have access to standardized real-time valuations.

Investors would no longer feel that they are kept in the dark for most of their investment journey. Greater valuation visibility will enable investors to better time their entry and exit decisions and improve risk hedging strategies. Additionally, this will empower limited partners to hold general partners accountable.

Robust lending

With greater asset price visibility, debt financing would be a lot more accessible for private companies. Reduced uncertainty and opaqueness will certainly reduce risk premiums and borrowing rates.

From the perspective of lenders, real-time asset valuations can significantly catalyze collateral assessments. Another benefit is that applying pre-existing debt health metrics and models to private equity would become easier.

Furthermore, transparency in asset prices would alleviate the need for stringent covenants.

Increased deal velocity

Real-time company valuations will directly reduce the time spent on due diligence and enable faster closing of deals. When deals are financed by banks and other financial institutions, this software will make it easier to bring the selling side, buying side, and financing side on the same page.

Also, by driving investor confidence and debt flow into private equity, real-time insights will indirectly increase liquidity in private equity markets.

Know your worth, anytime and all the time!

Eqvista’s Real-Time Company Valuation® holds the potential to transform the private equity landscape by empowering confident, data-driven decisions. Through the strategic partnership between Eqvista and Startupr, our clients will now benefit from end-to-end support, right from incorporation and compliance to investor relations and funding guidance.

Contact Eqvista today to access instant and audit-ready valuation insights that accelerate your next move!

Last update: October 2025